Was Nomics. Nomics however is daily raising that bar for all crypto projects, that excellent and flawless can and should be a thing. Brian Krogsgard: Delta’s really awesome. You can construct everything. We’re consuming this exactly like a customer is. Who cares? Thanks for having me.

Exchange rates on 30 crypto exchanges, 9940 trading pairs online

Rank With increasing threats of hacking Cashfinex is designed with the high level of security. It is an advance With i Rank 1. Decentralized Exchange.

Search & Compare

We are a high-quality, one-stop-solution market data provider for cryptocurrency markets. All CoinAPI data is standardized. Market symbol details and asset codes are double-checked by real humans to ensure maximum quality. For more demanding integrations requiring real-time market data streaming, we have access through WebSocket and FIX protocols. We provide helper libraries for the most popular programming languages, so you can focus on the most important aspects instead of wasting time connecting the pieces together. In addition to a real-time data streaming service, we provide access to a database of historical market data.

Browse our Data collections

API Documentation. Log In. Sign Up. Personal Features. Live Market Data. Learn. Trade and Order Book Websockets. Cryptkcurrency to our real-time trade or order book websocket channels for every asset across each exchange we support. Designed for real-time cryptocurrency trading, our websockets provide live updates for rapid order placement decisions. The personal plan includes 2 million websocket hours per month. Up to 20 Exchange Accounts. Link up to 20 exchanges to execute trades, collect exchange account information, track balances across exchanges, and manage your portfolio.

Shrimpy automatically collects balance data from each exchange account on a 15 minute interval. To manage more users, check out the Startup plan. Exchange Trading. High Fidelity Portfolio Backtesting. Examine the historical performance of portfolios which take advantage of various rebalancing strategies. Each backtest utilizes precise market data cryptocurrejcy each individual exchange exchanhe simulate every trade.

Asset Selection Insights. Access aggregated information about Shrimpy users for real-time asset percent dominance and popularity. This provides an accurate representation of where real crypto users are placing their funds. Move sliders to select a plan with features according to your needs! Active users are counted as the number of users which have so real time cryptocurrency exchange been active since the start of this subscription period.

A user is marked as active by Shrimpy when a request is made to collect data, execute trades, update exchange accounts, change rebalancing strategy, or any eral request which is specific to an individual user. General requests to public endpoints, market data endpoints, asset insights, or websockets will not mark a user as active. A trade data point is an individual trade collected from a single exchange.

One trade data point is exactly equal to one trade executed on the exchange. Note: The data plan you select provides the maximum number of data points you can collect. Each trade data point is worth 1 data credit.

Order book snapshots are a list of the buy and sell orders for an individual asset pair at a specific time in history. Our system stores snapshots on a 1 minute interval across all trading pairs on each exchange we support. Each order book snapshot is worth 10 data credits. Historical candlestick OHLCV data is used to analyze the market by grouping data points into consistent intervals.

Shrimpy calculates each candlestick by evaluating the tick-by-tick trade data on each exchange to provide the most accurate calculation possible. Note: The data plan you select provides a maximum number of data credits you can use across all historical data endpoints every month. Each candlestick is worth 10 data credits. Websockets are used to collect real-time order book and trade data from individual exchanges. Shrimpy allows developers to connect to up to 1, trading pair subscriptions per IP.

While connected to a websocket Shrimpy charges a flat rate of 6 data credits per hour per subscription. That means if you subscribe to 10 trading pairs for 10 minutes, it would cost 10 data credits. Note: The data plan you select provides the maximum number of data credits you can use across all historical data endpoints every month.

Startup Features. User Management. There are no limits to how many users you can manage with Shrimpy. With our flexible pricing plans, you rea manage anywhere from 1 to 1 Million users with ease.

Exchange Account Management. Link exchanges to users to allow each of your users to execute trades, collect exchange account information, track balances across exchanges, and manage their portfolio.

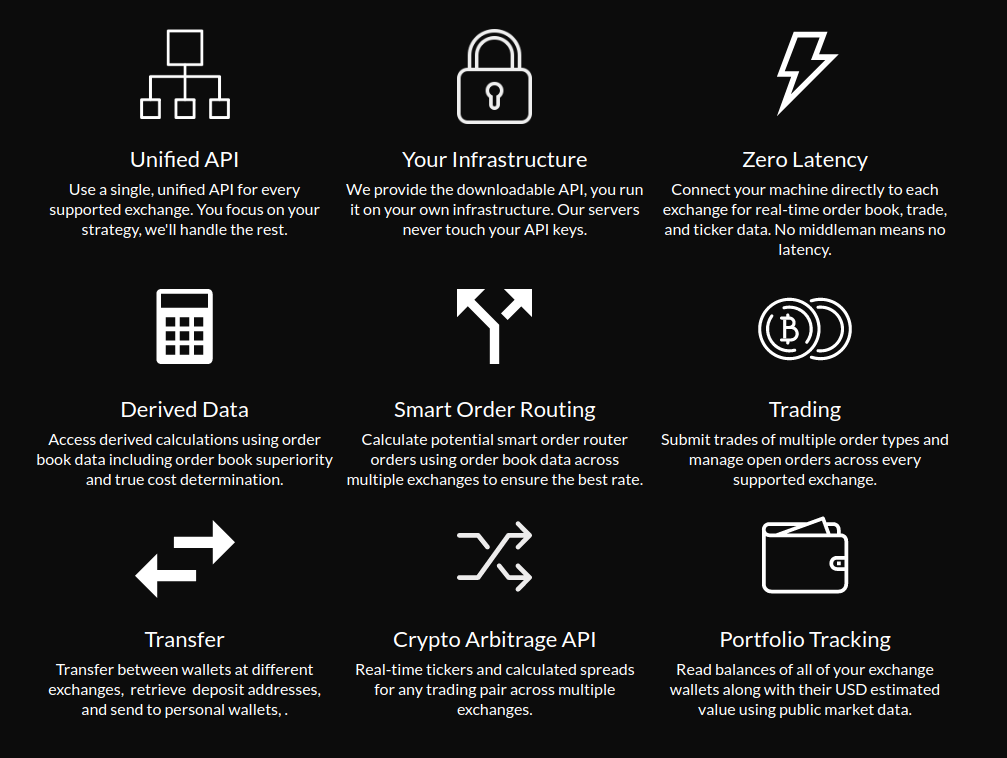

Real-Time Limit Order Execution. Smart Order Routing. Intelligently route trades through alternative trading paths by taking advantage of the built in smart order routing features in Shrimpy. Smart order routing analyzes the market in order to determine what are the best routes to take when moving funds from one asset to.

Automated Portfolio Rebalancing. Instantly allocate diverse portfolios, schedule periodic rebalances, and manage user funds with ease through our portfolio management endpoints. Historical Order Book Snapshots. Historical Trade Data. Historical candlestick OHLCV data includes the open, high, low, and closing prices in addition to the volume over the aggregated intervals.

Designed for real-time cryptocurrency trading, our tlme book and trade websockets provide live updates for rapid order placement decisions.

Priority Support. Mission critical systems require exceptional support. Your requests will be addressed in a prompt manner at every turn.

Your business requires additional support. Our team is prepared to provide higher data limits, integration assistance, dedicated hardware, or any custom features you need. To tme a price estimate for Enterprise Shrimpy, please contact our sales team.

We will get back to you as soon as possible. Enterprise Features. Colocation Services. Get an edge by locating your trading system as closely to each exchange as possible. This allows for instant order placement before other traders even have the chance to receive updates that the order book has changed.

Dedicated Hardware. Access hardware which is designed for your needs. Instead of sharing resources among other users, your hardware will be completely independant and be operated independently of our other services. HFT Infrastructure. High Frequency Trading requires the fastest hardware, networking, and logic to outperform other traders in the market.

Cryltocurrency Shrimpy team can help you reach your goals and beat the competition. Global Real-time Trading Network.

Connect to every major cryptocurrency exchange through a real-time network of colocated servers with each exchange. Custom Feature Development. Need something not listed here? Our team is happy to build custom features for you based on request. All exchage reserved.

LIVE TRADE of how I made $600 Day Trading Cryptocurrency Binance For beginners 2018

Built for FinTech Developers

And not only do real time cryptocurrency exchange have ticker data, but we have multiple candlestick links on the back end for aggregate market, so all Bitcoin markets, all Ethereum markets, et cetera. So if you need super low latency order book snapshots and trading data, that’s something we can. I think what I actually asked you all about in that thing was whether y’all could do So we know it from real time cryptocurrency exchange perspective and we create stuff that we want to dog food. So I’m really excited to be able to share with my listeners that that’s now available because I know a lot of technical traders want to be able to check out the order books, get an idea of depth on the price a while they’re looking at their portfolio. You can always expect that the fields returned from the API will be in a consistent format. In order to be successful, traders need to learn discipline and ignore emotional responses. The second you want to ingest data from multiple exchanges, things get a lot trickier. It’s great to be. So data for orders that haven’t been filled or have been canceled or maybe the order’s been placed and that order converts to an actual trade and then add to that blockchain data and you have a huge undertaking in terms of.

Comments

Post a Comment