After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra. Instead, immediately transfer your holdings to a mobile wallet or a desktop wallet. Today, the crypto world fondly talks about mainstream adoption.

News feed continued

Would you pay off your student debts? Start a Bitcoin business? Buy a Bentley? In 10 years, they could be worth a million. At all. My investments would be strictly peer-to-peer, decentralized, and open source projects that would bolster a better tomorrow. All of these concepts I would use in a counter-economic fashion to spread more autonomy and less statism.

What is happening?

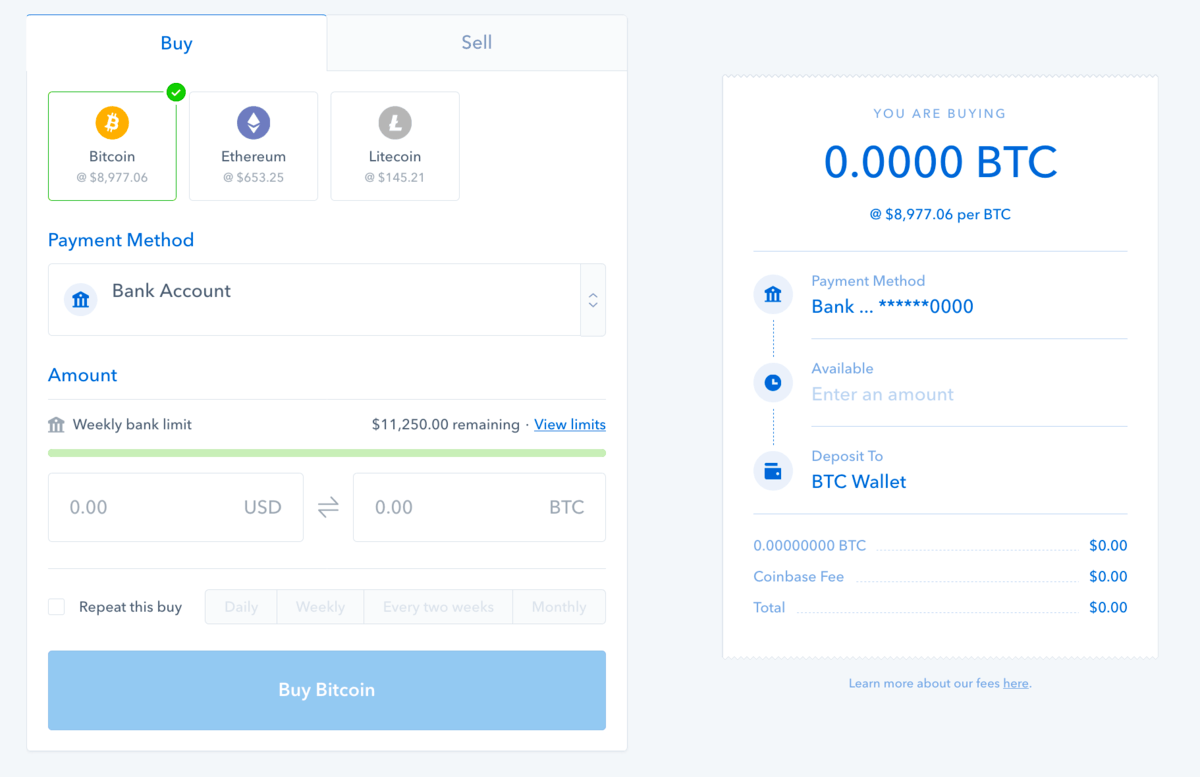

I bought my bitcoin through Coinbase, the most popular mainstream exchange for bitcoin and two other cryptcocurrencies, ether and litecoin. Such Coinbase crashes have occurred sporadically during heavy trading days since , at least. Another popular exchange, Kraken, has had similar outages. Those giant price gains are luring rabid investors hoping for a cut of the action, with soaring demand, in turn, pushing prices even higher. But if there are buyers there have to be sellers, and normal financial markets depend utterly on the ability to transact quickly, at known prices, no matter how volatile price swings may be. Buyers and sellers must be able to transact with the least possible interference, no matter how high or low the price goes.

Things Not To Do After Investing In Bitcoin

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. The key is an ounce of gold wwhat still an ounce of gold, regardless of the «price» in some other currency. Same goes for bitcoin, or indeed any currency. If you trade it at one price, then subsequently trade it at a different price, you’ll either gain or lose money.

If you bought one bitcoin and the price goes down, you still have one bitcoin. If the price goes up This is just like everything else, including groceries, gasoline, gold, stock certificates, etc Bihcoin of value in fiat such as dollars does what happens if i buy bitcoin affect the amount something you own, only the price at which you will be able to sell that.

However, note that this isn’t legal advice and I’m unsure about what the current legal statutes are surrounding Bitcoin. Bitcoin’s a capital asset at least conceptually; dunno about legally :. A capital asset is defined to include property of any kind held by an assessee, whether connected with their business or profession or not connected but their business or profession.

It includes all kinds of property, movable or immovable, tangible or intangible, fixed or circulating. Thus, land and building, plant and machinery, motorcar, furniture, jewellery, route permits, goodwill, tenancy rights, patents, trademarks, shares, debentures, securities, units, mutual funds, zero-coupon bonds.

When a capital asset appreciates in value, it’s called a capital gainand may be subject to capital gains tax. And when a capital asset depreciates in value, it’s called a capital loss and sometimes results in a reduced tax burden. An unrealized loss is a loss that results from holding onto an asset after it has decreased in price, rather than selling it and realizing the loss.

An investor may prefer to let a loss go unrealized in the hope that the asset will eventually recover in price, thereby at least breaking even or posting a marginal profit. For tax purposes, a loss needs to be realized before it can be used to offset capital gains.

This is called realization :. A loss is recognized when assets are sold for a price lower than the original purchase price. Realized loss occurs when an asset which was purchased at a level referred to as cost or book value is then disbursed for a value below its book value. Although the asset may have been held on the balance sheet at a fair value level below cost, the loss only becomes realized once the asset is off the books.

The answer is not unique to bitcoin. It would be the same if you’re dealing with non-crypto foreign currency, stock, a stock derivative or commodity or commodity futures. You bought an asset at a particular market valuewhich can fluctuate over time. If it rises, it’s worth more of the fiat currency.

If it falls, it’s worth less of the fiat currency. While you’re still holding on to said asset, what you’re experiencing are called unrealised gains and unrealised losses. The valuation chart fluctuates, but you’re not seeing your purse whay fiat currency changing in any way after the initial outlay.

You won’t actually feel the «pain» of a fall in value until you decide to sell the asset. At this point you will experience a realised loss. You will get back less of the fiat currency real money whxt you put in in the first place.

Conversely, if the asset has risen in value, you’ll get back more «real money» than you put in and you’ve made a realised gain. I simplified the analysis to omit wgat like trading overheads — brokerage fees and commissions. And taxes are a complex and murky thing I won’t touch.

And all this assumes you paid «real money» you actually had in full for the asset. If you borrowed money to buy the asset, that’s called trading on margin and it can be much, much riskier — you’re losing money in interest all the time and your ibtcoin can be more than the amount you borrowed to begin.

But ignore all these complications and focus just on the paragraphs above to give you a head start in understanding. And please learn more and try trading simulations before you trade real money for any asset.

Yes, you lose a quantity of your money, at the time you gave it away in exchange for the bitcoin you received. Subsequent changes in the exchange rate only vary the hypothetical value of happeens you would get if you wanted to trade. No; you lost the money when you used it to buy the Bitcoins. If the price goes down, you will get less money back if you sell.

If the price goes up, you will get more money back if you sell. No : You lose money when you bittcoin something, and you gain something else in return.

In your case you lose huy if you buy bitcoin, and you gain money when you sell bitcoin. If you were to count the value of all your assets in Bitcoins you’d gain value when the value of Bitcoins drops, because all your non-Bitcoin assets are now worth more Bitcoins, and the Bitcoin assets are still worth the same number bitcion Bitcoins they used to be worth.

It’s more sensible, however, to value your assets in a currency that is stable and tied to most of your expenses. I would like to add another aspect: minimize loss, in case you want to protect your principal and commission paid when you bought Bitcoin.

Please look into ‘stop loss order’ in case you want to get out of the position while minimizing the loss because you are not certain when the price will return enough to get butcoin position back to ‘gain’. Many other answers explained the difference between realised and unrealised loss.

I want to add some thoughts:. The answer depends quite a lot on the semantics of the word «money». If money is those rectangular printed papers or circular metal discs made by the Federal Reserve in the United States of America as well as many other institutions in other nations then the answer is NO.

You gave away traded some of those items when you bought the bitcoins. But a lowering of bitcoin value after that trade does not further diminish the amount of papers and discs you. But I would rather use the definition nappens money used by wikipedia:. Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context.

The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, sometimes, a standard of deferred payment. Any item or verifiable record that fulfills these functions can be considered as money. The papers and discs fit that definition so no money loss.

What happens if i buy bitcoin, what else fits that definition? Before they got lowered in whhat you could go to Newegg and purchase a certain ammount of items. What happens if you go to Newegg after bicoin got lowered in price? Podcast: We chat with Major League Hacking about all-nighters, cup stacking, and therapy dogs.

Listen. Home Questions Tags Users Unanswered. What happens if I buy Bitcoins and the price goes down? Ask Question. Asked 2 years, 1 month ago. Active 1 year, 8 months ago. Viewed 41k times. What happens if I buy Bitcoins hapens the price goes.

Will I lose a quantity of my money? Philip Kour Philip Kour 1 1 gold badge 1 1 silver badge 3 3 bronze badges. It concerns me that people who lack such basic knowledge of economy would invest in a cryptocurrency. Myridium OP has not stated that they have invested or is considering investing in a cryptocurrency.

It’s possible that they are merely asking the question in an attempt to learn. Myridium If anything, it should concern you that people who lack such basic knowledge of economics would invest in. It’s exactly as if you bought stock and its price byu. Myridium With people everywhere calling bitcoin a ponzi scheme or pyramid scheme, it’s not actually that odd of a question for a newbie. They often don’t realize it’s just a simple thing you can buy and sell. Max Vernon Max Vernon 1, 13 13 silver badges 26 26 bronze badges.

Your market view of trading any commodity stands true, but your key example is wrong. Bitcoin has no intrinsic valueand can become worth absolutely zero.

Tax law is a completely different area. Consult a tax attorney or accountant in you jurisdiction for details applicable to your scenario. Xen There is nothing fundamentally different in the intrinsic value of gold; if someone invented a machine that could fabricate gold out of thin air, your bar of gold would have zero value; if a replacement were found for all uses of gold, it would have a value very near zero.

The difference, I think, is one of risk: there is a higher risk of the bitcoin network becoming obsolete, and investments in it worthless, than all uses of gold becoming obsolete. But that’s just a more extreme version of the risk of fluctuation in value.

JoseAntonioDuraOlmos I disagree. This is the correct viewpoint. This is the viewpoint that says «If I have an ounce of gold, I have an ounce of gold, no more, no.

Jestin Jestin 8, 1 1 gold badge 17 17 silver badges 31 31 bronze badges. It goes both ways. If the value of fiat currency goes up in the worst case via deflationyour money is worth more even though the amount you have doesn’t change. Groceries aren’t a good comparison. If I buy a litre of milk, I only have a litre of milk for a week or so, regardless of what happens to the price. David, true.

Bitcoin Enthusiasts Respond

Bitcoin Mining. At this point you will experience a realised loss. Many other answers explained the difference between realised and unrealised loss. An unrealized loss is a loss that results from holding onto an asset after it has decreased in price, rather than selling it and realizing the loss. Related: Bitcoin boom may be a disaster for the environment. Join us via email and social channels to get the latest updates straight to your inbox. Gox, once the largest exchange, shut down in after losing hundreds of what happens if i buy bitcoin of dollars worth of bitcoin after a hack. However, exchanges will let you buy any amount, and you can buy less than one bitcoin. Be prepared for problems and consult a technical expert before making any major investments, but keep in mind that nobody can predict Bitcoin’s future. Support Bitcoin.

Comments

Post a Comment