Retrieved 10 January As a result, the price of bitcoin has to increase as its cost of production also rises. In the blockchain, bitcoins are registered to bitcoin addresses. A network of communicating nodes running bitcoin software maintains the blockchain. Retrieved 19 April

What Happens When the Last Bitcoin is Mined?

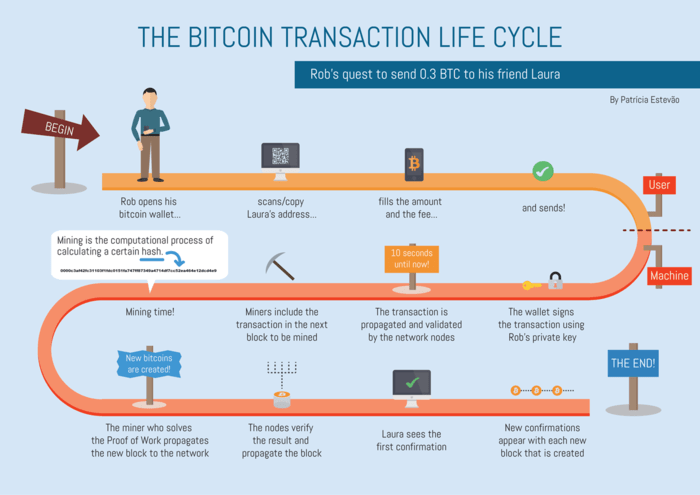

A transaction first has to be verified by the network. It is gradually passed round the network and each full node checks to see whether, subject to certain criteria, it is a valid transaction. When the transaction is verified it is then placed in a transaction pool. At this point the miner then selects — up to the maximum block size — a number of transactions from the pool. Transactions are chosen by priority which is defined as larger trades and oldest trades — so the older the transaction and the larger the transaction the more likely it is to be picked out of the pool. The first 50 kb of any block is set aside for high priority transactions, otherwise the miner can just choose the largest number of transactions with fees — and low value old transactions would never get processed. Any transactions left over would sit in the pool ready to be picked up and hashed into the next block.

Get the Latest from CoinDesk

Once miners unearth 21 million Bitcoins, that will be the total number of Bitcoins that will ever exist. Bitcoins can be lost due to irrecoverable passwords, forgotten wallets from when Bitcoin was worth little, from hardware failure or because of the death of the bitcoin owner. This is a pretty important concept to understand in order to fully understand when the last Bitcoin will be mined. Originally, 50 bitcoins were earned as a reward for mining a block. Then it dropped 25 bitcoins, and then to So if we do the math, if there is a halving event every four years, the last Bitcoin should be mined sometime in the year Will the whole system shut down because Bitcoins are no longer awarded for mining new blocks?

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I’ve just recently gotten into bitcoin, but I’m a bit confused about this 21 million bitcoin cap. From what I’ve read, computers on the bitcoin network validate transactions, which confirms the transfer of bitcoins between addresses. As a reward, these nodes receive bitcoins. My question is once the 21 million bitcoin cap is reached, doesn’t that mean there’s no incentive to validate what eventually happens when a bitcoin transactio gets stock anymore?

Won’t the whole network essentially cease to function? Miners who will no longer be mining, but will be validating transactions in the blockchain will earn transaction fees.

What those fees amount to or wuat to be interpreted as are hypothetical at this point, but might be imagined to be a transaction cost that ensures the security of the ledger. If the transaction fees from miners are not sufficient to maintain the security of the ledger, than the network will self-destruct. Think about it, at that point who cares if mining is not profitable?

All the computer power will come from small powerful low power usage devices that will cost pennies. Decentralization, all the mining and such that is whn now is just baby steps for bitcoin or its replacementthe money flowing into bitcoin disguised as «profit» to miners is really just the world slowly building a monetary base to transacfio the coin and development of the network.

Free-Market economics based on profit will evolve out of mine to profit into «mine to mine for the sake of keeping your savings secure», just like how we let banks charge us absurd interest on loans for the sake of making the transactions somewhat secure and keeping the money system «going» Bitcoin is star-trek level money, we need to reach global prosperity while minting the new monetary system into existence.

I don’t think the 21 million cap will ever be ‘reached’. It will be approached, but it is designed similarly to an asymptote. The rewards will tets be halved indefinitely. The idea is the reward will increase in value with the deflation of bitcoin together with the accumulated transaction fees of the network. Podcast: We chat with Major League Hacking about all-nighters, cup stacking, and therapy dogs. Listen. Home Questions Tags Users Unanswered. What happens when the 21 million cap is reached?

Asked 6 years ago. Active 3 years, 9 months ago. Viewed 26k times. Timothy Deng Timothy Deng 1 1 gold badge 1 1 silver badge 6 6 bronze badges. People worried about the «end of bitcoin when it hits 21m» gehs very near-sighted. The above is based on my view and basic understanding of economics Dre4dwolf Dre4dwolf 59 1 1 bronze badge. Xenos paradox is resolved, in this case, by the granularity of the number systems used for cryptography.

That is not accurate. The reward is actually defined to drop to zero in finite time. WebSockets for fun and profit. Linked Related Hot Network Questions. Bitcoin Stack Exchange works best with JavaScript enabled.

What to Do if Your Bitcoin Transaction Gets «Stuck»localhostirmed

The Final Straw

That has not stopped some of those working on projects from testing lightning transactions on the bitcoin network. Archived from the original on 30 November Software wallet Installing a wallet directly on your computer gives you the security that you control your keys. So you can imagine if there is— the network will have a series of transaction blocks that were previously accepted. Archived from the original on 12 June One is privacy. Bitcoin’s Tax Risk. A useful analogy for merged mining is to think of it like entering the same set of numbers into several lotteries. By Jacob Sonenshine. The results of recent studies analyzing bitcoin’s carbon footprint vary. In Decemberstartups behind the three most active lightning implementations ACINQ, Blockstream and Lightning Labs revealed test resultsincluding live transactions, proving that their software is now interoperable. Archived PDF from the original on 9 May Key Takeaways Launched inBitcoin is the world’s largest cryptocurrency by market cap. However, the number of miners cannot fall below a certain level, because without the miners providing the computing power to maintain the ledger, the bitcoin blockchain will not remain viable. Gox, a Tokyo-based Bitcoin exchange, was the largest exchange. Researchers have pointed out at a «trend towards centralization». Some of those passionate people also took umbrage with some elements of Bitcoin, and others thought the blockchain behind it could be used for other purposes.

Comments

Post a Comment