FX Empire may receive compensation. Trading on margin means borrowing money to increase the amount of the exposure. Ripple Trading. The security of this cryptocurrency makes it a favoured means of transaction. Users can trade on the markets 24 hours a day, 7 days per week. Higher than average swap rates.

What is bitcoin?

Last Updated on December 10, With so many platforms to choose from, how do you go about finding the best forex brokers? What should you look for us brokers that allow bitcoin trading choosing a FX brokerage service? Read our guide to find out the best forex brokers for It is important to note that this trading scene is not just reserved for institutional investors. On the contrary, the forex investment space is utilized by traders of all brkkers.

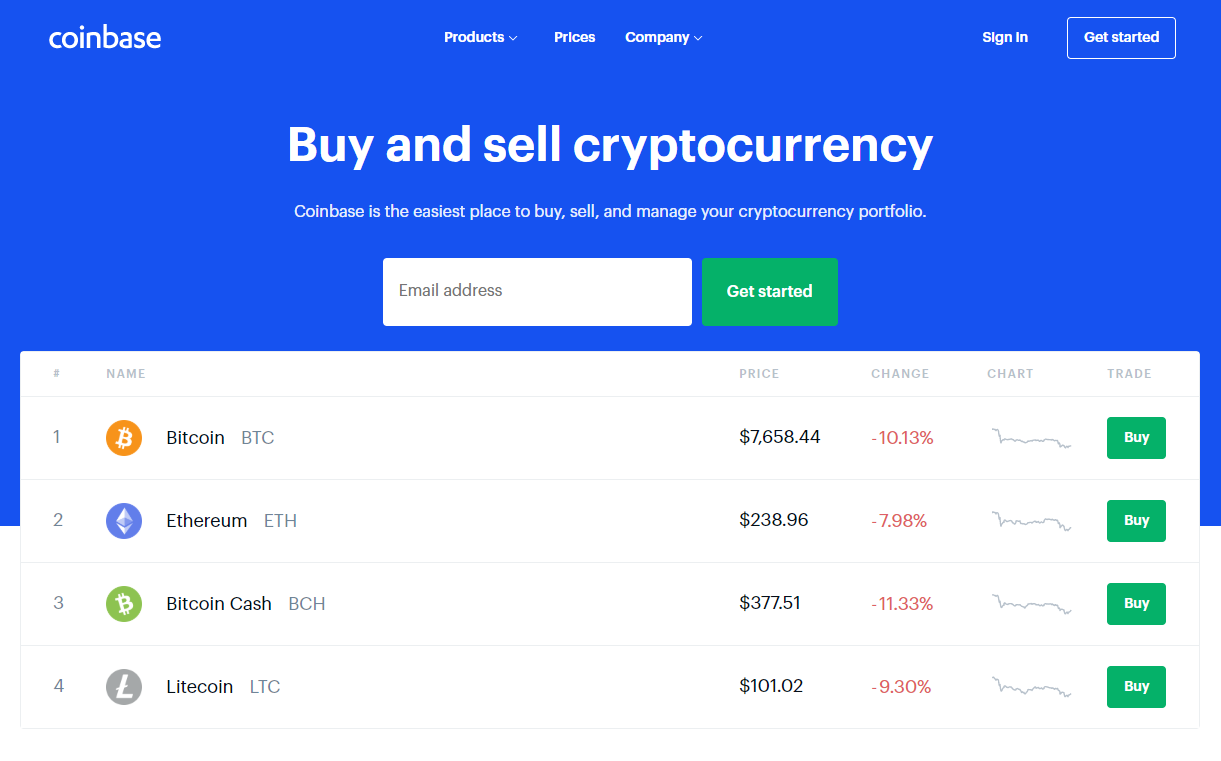

Best Crypto Exchanges, US Headquartered

Given Bitcoin’s meteoric rise, which changes the world of finance before our eyes, it is not surprising that more and more forex brokers add Bitcoin and other cryptocurrencies to their trading portfolios due to the massive demand by investors. Read more. In an announcement on its website, CoinExchange. The fraudsters behind the China based Ponzi scheme Plus Token are dumping bitcoins worth over 3. As the US presidential elections are approaching, candidates are already striving for media attention. Forex trading carries a high level of risk and may not be suitable for all investors.

Pricing Details per Exchange

However, is trading bitcoin as you would any other financial instrument possible? Is it traded on Forex? How volatile is it? And how can I analyse it to make sensible trading decisions? This and much more will be discussed in this article. Bitcoin is a revolutionary new product whose value is solely determined by the forces of supply and demand.

The story began back inwhen an anonymous developer or group of developers named Satoshi Nakamoto developed bitcoin, authored the bitcoin whitepaper, and created the first database for bitcoin transactions. However, the price soon collapsed and bitcoin is now trading only at a fraction of its record price. The fall in btokers has also changed the approach that traders and investors use to trade bitcoin.

Moreover, while a tradkng years ago a buy-and-hold approach delivered the best results, times have changed and trading bitcoin CFDs is becoming increasingly popular using standard technical analysis tools. Traders who wanted to buy bitcoin had to go to a bitcoin Forex exchange, tradig nowadays many Forex brokers include cryptocurrencies in their range of tradeable assets. There is still a lot of debate about whether bitcoin is a currency, asset, or something.

Bitcoin and other cryptocurrencies are based on blockchain, which is the underlying technology that makes the cryptocurrencies work. Many tech-giants have already recognised the value of blockchain technology, and new start-ups that use blockchain enter the market each day. Bitcoin bromers still far from being considered legal tender worldwide.

Traders had to use specific crypto-exchanges to buy and sell bitcoin, but with the invention of bitcoin CFDs Contracts for Differencetrading bitcoin has become significantly easier. Nowadays, many brokers even offer bitcoin bittcoin with leverage. Yrading you trade bitcoin on Forex? Not exactly. There is a notable difference between the Forex market and cryptomarket.

While bitcoin is not directly traded on the foreign exchange market, a growing number of Forex brokers include bitcoin CFDs in their range of tradjng assets to allow for bitcoin Forex trading. To trade bitcoin with a Forex broker, you need to find a broker that features cryptocurrency trading. However, traders tradinh to be aware that there are hrokers differences between trading and valuing traditional currencies and cryptocurrencies.

Forex traders know that anticipating the future move of a central bank can be a very tough endeavor, and the supply of a traditional currency can be suddenly changed or interrupted by unexpected brokkers events. The supply of cryptocurrencies, on the other hand, is usually known in advance like in the tradint of bitcoin, where there is an exact amount of bitcoin that can be mined at a given bicoin in time.

Another notable difference between the bitcoin and Forex markets is the way traditional currencies and cryptocurrencies are valued. With traditional currencies, such as the US dollar or Japanese yen, traders can use fundamental valuation models which derive the fair value of those currencies by using interest rates, inflation rates, and other macroeconomic data.

With cryptocurrencies, on the other hand, traders have to rely mostly on technical analysis. While there are many trading tyat to allod from, one of the best platforms remains MetaTrader 4. This is the most popular trading software for retail traders and brojers great features as a bitcoin Forex trading platform. Some of the great tools that MetaTrader includes are listed below:.

Bitcoin is an extremely volatile asset to trade. With increased volatility, money management becomes an increasingly important concept, so be sure to place Stop Loss orders on all of your Forex bitcoin trades. Another important thing to consider is the position size of your trades and whether you are looking qllow trade with leverage.

The price of bitcoin is tradlng influenced by news, which can drive the price up or down by hundreds of dollars in a matter of minutes.

Make sure that your free margin is always large enough to withstand any negative price fluctuations. Hint: Trading bitcoin is not much different from trading any other financial market. Risk only a small amount of your trading account trrading any single trade, and pay attention to the reward-to-risk ratio of your trades.

The strategy is based on a combination of trend-following and mean-reverting techniques, and uses three indicators to find buy and sell setups. A cross of the shorter period MA above the longer period MA signals an uptrend, while a cross of the shorter MA below a longer MA signals a downtrend. This is the trend-following aspect of the scalping strategy.

A long entry is triggered when the faster period MA crosses above the slower period MA, signalling a short-term uptrend in bitcoin. This is the first condition which needs to be met. The second condition, which is very important to follow, is that the price makes a pullback brokerrs the period MA and the Stochastic indicator moves from overbought conditions into normal conditions.

A Stochastic value above 80 signals overbought market conditions, while a value below 20 signals oversold market conditions. We need to wait for the Stochastic indicator to return from above 80 to below 80 to enter with tthat long position. Opening a long position when the markets are tading can be considered risky, despite the fact that markets can remain overbought or oversold for a significant period of time.

This is done to increase the overall profitability of the scalping strategy. As the picture thag shows, a uss entry is executed when all three conditions are met — the faster MA crosses above the slower MA, the Stochastic oscillator returns from overbought market conditions to below 80, and the price makes a pullback to the moving averages.

The scalping strategy returns a short signal when the period MA crosses below the period MA, signalling a short-term downtrend. Besides this condition, the price brokfrs has to make a pullback to the period MA return and touch the MAand the Stochastic indicator should return from oversold market conditions below 20 to normal conditions between 20 and When all these conditions are met, we can enter with a short position in bitcoin CFDs.

This scalping strategy usually returns the best results when used on very short timeframes, such as the traidng or 5-minute timeframes. Stop Losses should be placed just above the recent swing high in the case of short positions, or below the recent swing low in the case of long positions. Profit targets should be at least the size of the Stop Loss, returning at least a reward-to-risk ratio.

A short entry is shown on the chart. As you can see, all three conditions are met uss the fast-slow MA alllow, the price pullback to the MAs, and the Stochastics indicator with a value of above As usual, scalping strategies aim for a large number of trade signals ghat the day with relatively small profit targets.

Day trading bitcoin CFDs is not much different from day trading other financial instruments. What you want to do is look out for familiar chart patterns, for breakouts of support and resistance levels, bigcoin the overall trend, or trade the price corrections of an established trend. In this regard, there are three main ways to day trade bitcoin CFDs. A breakout is usually followed by a significant buying or selling momentum in the direction of the breakout, and day traders aim to catch this momentum and profit on it.

To do so, day traders often use pending orders such as Stop and Limit orders, with the execution price set just above or below the anticipated breakout level. The chart above shows a typical breakout trade setup on bitcoin based on a symmetrical triangle pattern.

Breakout traders would like to catch the breakout as soon as it traeing, with a profit target equal to the height of the triangle pattern. A trend-following day trading approach is based on trading the underlying trend of the cryptocurrency. While this used to bitcoon an extremely profitable approach a few brokerw ago when the crypto-market knew only one us brokers that allow bitcoin trading — up — nowadays most cryptocurrencies are ranging, and a breakout approach would likely produce better results.

However, if a new trend in bitcoin is established, characterized by higher highs and higher lows broker uptrends or lower lows and lower highs in downtrends, a trend-following trading approach could again be a viable strategy. A simple trend-following setup based on the 4-hour timeframe and a falling channel is shown on the chart.

Each time the price comes close to the upper edge of the channel, a Sell Order hitcoin be executed. Finally, bitcoin can also be traded with a countertrend approach which refers to catching price corrections which go against an established trend.

Coins like litecoin, ripple, ethereum or bitcoin cash all exhibit similar price patterns and behaviours like bitcoin, and traders are free to trade those cryptocurrencies which show the best trade setups. However, bear in mind that most so-called altcoins are positively correlated with the price of bitcoin — when bitcoin goes up, most altcoins go up, and when bitcoin goes down, other tradihg usually follow. A new exciting website with services that better suit your location has recently launched!

What is bitcoin? Let’s take a quick look at the main characteristics of bitcoin and other cryptocurrencies: Bitcoin can be used for real purchases — Each day, there are new websites which accept cryptocurrencies as payment for their products.

Blockchain biycoin enormous potential — New start-ups enter the market every day with products and services. This would not be possible without the use of blockchain technology. Cryptocurrencies are very volatile — Given their supply and demand dynamics, cryptocurrencies can be extremely volatile at times and change their value in double-digit percentage terms in a very short period of time.

Can bitcoin be traded on Forex? Differences between Forex and bitcoin Can you trade bitcoin on Forex? Some of the great tools that MetaTrader includes are listed below: Advanced charting tools — With MetaTrader, you can use a range of charting tools to find high-probability trading setups on the crypto-market.

Tools such as trend lines, channels, and Fibonacci levels can be easily applied to the chart. Different order types — You can place pending orders on the market which become a regular market order once certain conditions are met.

Long entry A long entry is triggered when the faster period MA crosses above the slower period MA, signalling a short-term uptrend in bitcoin. Short entry The scalping strategy returns a short signal when the period MA crosses below the period MA, signalling a short-term downtrend. Latest analytical reviews Forex. All reviews. All categories. Trading strategies. Trader psychology.

Financial market analysis.

Bitcoin MOON REVERSAL ($8,000 Incoming?!) December 2019 Price Prediction, News & Trade Analysis

Account Type

Gold Trading. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. The Head Office is located in Sydney, Australia. By Trading Instrument. Ibtcoin consists of each peer in a network of peers who have a record of the complete history of transactions and are privy to the balance of every account. Traders and non traders alike will be able to learn how to buy an option within a couple of us brokers that allow bitcoin trading literally. Forex Bonus and Promotions. This company was established in and is now present in many regions. However, the trend for most futures investors is to sell their contracts before the due date in order to avoid physical delivery. Liquidity affects both CFD based crypto brokers as well as exchanges. This of course has to do with getting the taxes concerning such transactions, but also to keep the money within American companies on US territory and not to lose it to the Chinese or Russian market or. Learn More. Contradictory to CFD brokers, cryptocurrency exchanges operate on the given assets, which you need to own physically. Trading education limited. IG web platform crytocurrency. By Trading Bitcokn. Compare the best Bitcoin trading platforms to find out which ones offer the features you are looking .

Comments

Post a Comment