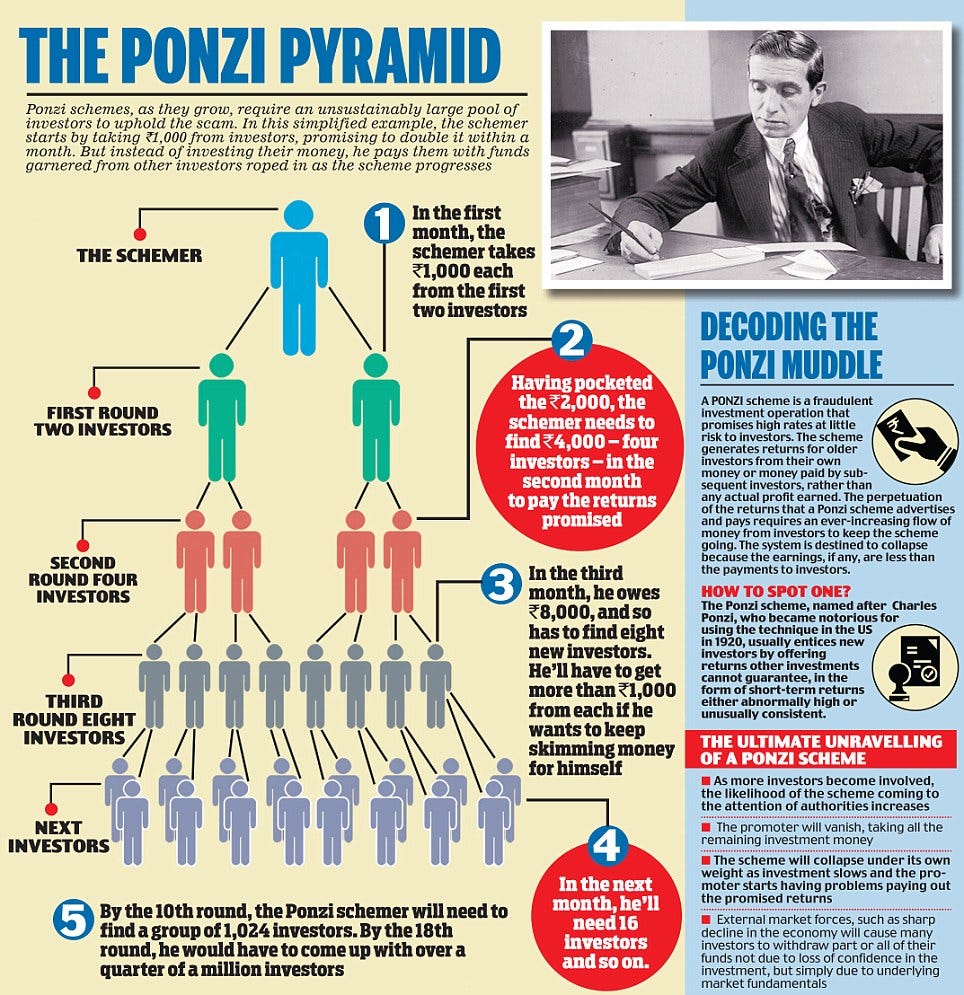

However, that does not constitute a new asset class, but rather an existing asset class with a new record-keeping system. This is a great opportunity for self-awareness. Even then people like this were saying this Internet thing is useless. It looks like a Ponzi scheme or a pyramid scheme. I like this article for two reasons. There are many more misleading statements made by this commentater and others promoting Bitcoin. When this flow runs out, the scheme falls apart.

Is Bitcoin a pyramid scheme?

Follow us on Twitter or join our Telegram. Everybody would like to make money as quickly and simply as possible. This has brought to life many frauds and scams that take advantage of gullible people. Pyramid schemes are one of them, as are Ponzi schemes and the similar. To answer that question, you need to know what a pyramid scheme really is: a business model that recruits members by promising them payment or rewards for enrolling others into it. Be wary of the people who claim .

Search form

I was asked whether Bitcoin is a Ponzi scheme as I was explaining Bitcoin. In support of the question I was presented with the following scenario. I didn’t know what to answer. Let’s assume Bitcoin started today and had no transactions and no customers. Tomorrow, the first 10 people ever buy into Bitcoin. Now again hypothetically, let’s say ALL 10 of these people want to sell their Bitcoin and cash out. I don’t believe Bitcoin is a Ponzi scheme, but this particular equation does not add up.

What Is A Ponzi Scheme?

Bitcoin is a distributed peer-to-peer digital currency that can be transferred instantly and securely between any two people in the world. It’s like electronic cash that you can use to pay friends or merchants. Bitcoins are the unit of currency of the Bitcoin. There are such things as physical bitcoinsbut ultimately, a bitcoin is just a number associated with a Bitcoin Address. A physical bitcoin is simply an object, such as a coin, with the number carefully embedded inside.

See also an easy intro to Bitcoin. Since Bitcoin is a new technology, what it is and how it works may be initially unclear. Bitcoin is sometimes presented as being one of three things:. While it is possible to find an individual who wishes to sell Bitcoin to you via Paypal, perhaps via bitcoin-otc most exchanges do not allow funding through PayPal.

This is due to repeated cases where someone pays for bitcoins with Paypal, receives their bitcoins, and then fraudulently complains to Paypal that they never received their purchase.

PayPal often in what ways is bitcoin similar to a ponzi scheme with the fraudulent buyer in this case, which means any seller needs to cover that risk with higher fees or refuse to accept PayPal altogether. Buying Bitcoins from individuals this way is still possible, but requires the seller to have some trust that the buyer will not file a claim with PayPal to reverse the payment.

You may find other exchanges and individuals willing to accept Paypal for Bitcoins at ExchangeRates. Proprice comparison of cryptocurrency exchanges and p2p market.

Please visit the Community Portal for links to Bitcoin-related forums. New bitcoins are generated by the network through the process of » mining «. In a process that is similar to a continuous raffle draw, mining nodes on the network are awarded bitcoins each time they find the solution to a certain mathematical problem and thereby create a new block.

Creating a block is a proof of work with a difficulty that varies with the overall strength of the network. The reward for solving a block is automatically adjusted so that, ideally, every four years of operation of the Bitcoin network, half the amount of bitcoins created in the prior 4 years are created.

A maximum of 10, Every four years thereafter this amount halves, so it should be 5, over years2, over yearsand so on. Thus the total number of bitcoins in existence can never exceed 20, See Controlled Currency Supply. Blocks are mined every 10 minutes, on average and for the first four yearsblocks each block included 50 new bitcoins.

As the amount of processing power directed at mining changes, the difficulty of creating new bitcoins changes. This difficulty factor is calculated every blocks and is based upon the time taken to generate the previous blocks. See Mining. Current count. Also see Total bitcoins in circulation chart.

The number of blocks times the coin value of a block is the number of coins in existence. The coin value of a block is 50 BTC for each of the firstblocks, 25 BTC for the nextblocks, then A bitcoin can be divided down to 8 decimal places.

Therefore, 0. If necessary, the protocol and related software can be modified to handle even smaller amounts. Unlike most currencies, Bitcoin amounts are highly divisible. This has led to a desire to create names for smaller denominations of bitcoin amounts, especially since transactions involving whole bitcoins are no longer quite so common. Bitcoin is decentralized, so there is no organization that can set official names for units.

Therefore, there are many different units with varying degrees of popularity. There is nothing particularly special about this unit, but it is by far the most common unit due to tradition. The smallest value that the Bitcoin network supports sending is the satoshi sometimes abbreviated satone hundred-millionth 0.

In other words, the network does not support sending fractions of a satoshi. Since it is a hard limit, it seems natural to use it as a unit, though it currently has very little value. The unit was named in honor of Bitcoin’s creator after he left — he was not so vain as to name a unit after.

The plural of satoshi is satoshi: «Send me satoshi». Another common unit is the bitone millionth 0. Bits are seen by some as especially logical because they have two-decimal precision like most fiat currencies. You can send 1. For an overview of all proposed units of Bitcoin including less common and niche unitssee Units. The block reward calculation is done as a right bitwise shift of a bit signed integer, which means it is divided by two and rounded.

With an initial block reward of 50 BTC, it will take many 4-year periods for the block reward to reach zero. The last block that will generate coins will be block 6, which should be generated at or near the year The total number of coins in circulation will then remain static at 20, Even if the allowed precision is expanded from the current 8 decimals, the total BTC in circulation in what ways is bitcoin similar to a ponzi scheme always be slightly below 21 million assuming everything else stays the.

For example, with 16 decimals of precision, the end total would be 20, Even before the creation of coins ends, the use of transaction fees will likely make creating new blocks more valuable from the fees than the new coins being created. When coin generation ends, these fees will sustain the ability to use bitcoins and the Bitcoin network. There is no practical limit on the number of blocks that will be mined in the future.

Because of the law of supply and demand, when fewer bitcoins are available the ones that are left will be in higher demand, and therefore will have a higher value. So, as Bitcoins are lost, the remaining bitcoins will eventually increase in value to compensate. As the value of a bitcoin increases, the number of bitcoins required to purchase an item de creases. This is a deflationary economic model. As the average transaction size reduces, transactions will probably be denominated in sub-units of a bitcoin such as millibitcoins «Millies» or microbitcoins «Mikes».

The Bitcoin protocol uses a base unit of one hundred-millionth of a Bitcoin «a Satoshi»but unused bits are available in the protocol fields that could be used to denote even smaller subdivisions. The blockchain base layer is not very scalable but layer-2 technologies can be used to greatly increase bitcoin’s scale. Lightning Network is one example which uses smart contracts to build a network where payments are routed along a path instead of flooded to every peer.

These payments can be nearly as secure and irreversible as blockchain transactions but have much better scalability as well support instant payments which are much more private. Other possible layer-2 scalability technologies are sidechains or a bitcoin ecash chaumian bank. Bitcoins have value because they are useful and because they are scarce. As they are accepted by more merchants, their value will stabilize.

See the list of Bitcoin-accepting sites. When we say that a currency is backed up by gold, we mean that there’s a promise in place that you can exchange the currency for gold. Bitcoins, like dollars and euros, are not backed up by anything except the variety of merchants that accept.

It’s a common misconception that Bitcoins gain their value from the cost of electricity required to generate. Cost doesn’t equal value — hiring 1, men to shovel a big hole in the ground may be costly, but not valuable.

Also, even though scarcity is a critical requirement for a useful currency, it alone doesn’t make anything valuable. For example, your fingerprints are scarce, but that doesn’t mean they have any exchange value. Alternatively it needs to be added that while the law of supply and demand applies it does not guarantee value of Bitcoins in the future.

If confidence in Bitcoins is lost then it will not matter that the supply can no longer be increased, the demand will fall off with all holders trying to get rid of their coins. An example of this can be seen in cases of state currencies, in cases when the state in question dissolves and so no new supply of the currency is available the central authority managing the supply is gonehowever the demand for the currency falls sharply because confidence in its purchasing power disappears.

Of-course Bitcoins do not have such central authority managing the supply of the coins, but it does not prevent confidence from eroding due to other situations that are not necessarily predictable. Yes, in the same way as the euro and dollar are. They only have value in exchange and have no inherent value. If everyone suddenly stopped accepting your dollars, euros or bitcoins, the «bubble» would burst and their value would drop to zero.

But that is unlikely to happen: even in Somalia, where the government collapsed 20 years ago, Somali shillings are still accepted as payment. Bitcoin does not make such a guarantee. There is no central entity, just individuals building an economy. A ponzi scheme is a zero sum game. Early adopters can only profit at the expense of late adopters. Bitcoin has possible win-win outcomes. Early adopters profit from the rise in value. Late adopters, and indeed, society as a whole, benefit from the usefulness of a stable, fast, inexpensive, and widely accepted p2p currency.

The fact that early adopters benefit more doesn’t alone make anything a Ponzi scheme. All good investments in successful companies have this quality. Early adopters in Bitcoin are taking a risk and invested resources in an unproven technology. By so doing, they help Bitcoin become what it is now and what it will be in the future hopefully, a ubiquitous decentralized digital currency.

It is only fair they will reap the benefits of their successful investment. In any case, any bitcoin generated will probably change hands dozens of time as a medium of exchange, so the profit made from the initial distribution will be insignificant compared to the total commerce enabled by Bitcoin. Worries about Bitcoin being destroyed by deflation are not entirely unfounded.

Unlike most currencies, which experience inflation as their founding institutions create more and more units, Bitcoin will likely experience gradual deflation with the passage of time.

BitConnect is the $900,000,000 Crypto Ponzi Scheme

Join Bitcoin Community

Everyone and his dog is buying bitcoin. To generate a return on bitcoin, one needs to accumulate bitcoin at a lower price before selling it for a too price. Daniel Ameli says:. Brian says:. The inability of cyber currencies to serve as a store of value and to efficiently function as a medium of wjat for buying and selling real goods and services will become increasingly evident. The pyramid shape comes from their tiered operational structure which sees revenue flow to the top handful of early adopters and highly skilled influential members. Rebel says:. Everyone is behaving like this is an emergency. This is a form of mania. Andre says:. Even in these less stable countries, the search activity is almost always now simialr less than it was during the the great price runup. All Ponzi schemes eventually collapse, of course, when sufficient amounts can no longer be raised from eimilar investors to pay off earlier investors. In fact, even bitcoin conferences sometimes refuse to accept bitcoins from attendees. It was first published in Whitesell says:.

Comments

Post a Comment