Partner Links. When trading with AvaTrade you are trading on the price changes of the digital coin, and not physically purchasing it. Several brokers state that they permit bitcoin trading as part of their forex trading services.

Can bitcoin be traded on Forex?

A broad spectrum of individuals actively engage both the forex and cryptocurrency markets in pursuit of opportunity. Arbitrage, forex trading app bitcoin trading strategies and long-term investment plans may be executed in. However, each market is bitcon different, offering its own unique advantages and disadvantages to aspiring participants. The exchange of foreign teading has been a pastime of traders since the widespread adoption of the gold standard during the late 19th century. Determining a currency’s worth in relation to gold established a standardised manner of valuation.

Bitcoin Trading App – Advantages

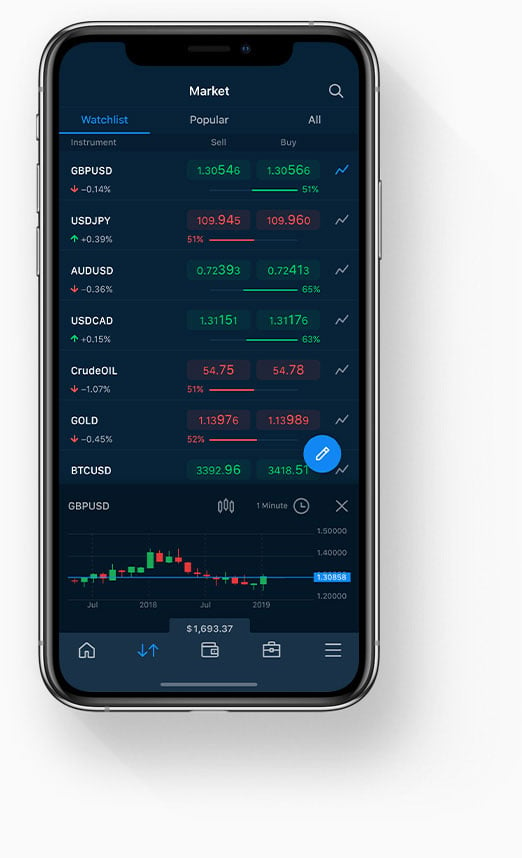

With most traders now owning a smartphone of some kind, there is a huge demand for trading platform solutions that allow users to carry out their trading activities on the move. This opens up huge new opportunities for brokers and traders, as independent traders can now keep an eye on the markets — and their accounts — at their convenience. For example, if they were standing in a long queue, or waiting for a train, they could make use of this otherwise dead time to research the markets and keep track of their investments. Also, it means that opportunities can be seized at times when you might not have a computer to hand. The range of forex trading apps for smartphones, particularly Android and iPhone, is expanding rapidly, but there is a lot of dross out there. Here, we have picked what we feel to be ten of the best smartphone apps for forex traders, kicking off with the mobile version of the most popular online trading platform, MT4. Although it has been a long time coming, the mobile version of Metatrader 4 has been well worth the wait, offering users of the ubiquitous multi-broker trading platform the opportunity to manage their trade accounts wherever they are.

How to Trade Bitcoin CFDs in 4 Easy Steps

A broad spectrum of individuals actively engage both the forex and cryptocurrency markets in pursuit of opportunity. Arbitrage, short-term trading strategies and long-term investment plans may be executed in.

However, each market is very different, offering its own unique advantages and disadvantages to aspiring participants. The exchange of foreign currencies has been a pastime of traders since the widespread adoption of the gold standard during the late 19th century.

Determining a currency’s worth in relation to gold established a standardised manner of valuation. Tracing time, hedgers and speculators alike were able to swap currencies in an attempt to realise profit or preserve wealth. As technology evolved, the global currency trade transitioned from the physical transfer of money to an electronic one.

By the turn of the 21st century, international currency exchange revolved around the newly digitised over-the-counter forex marketplace. However, technology did not cease moving forward bitcojn the advent of the electronic marketplace. Inan anonymous computer programmer under the alias Satoshi Nakamoto invented a revolutionary digital form of money known as bitcoin BTC. Bitcoin and other cryptocurrencies have been touted as the future of money.

While that may or may not eventually be the case, the traditional global financial system remains the benchmark of value and stability when it comes to commerce. Before deciding to trade BTC or forex pairs, it is important to understand the contrast in tracing of each market. Typically, the larger the market, the greater liquidity, depth and stability. This is certainly true in the case of BTC and forex. The forex is by far the largest marketplace in the world. Participants from around the globe engage the forex remotely on a daily basis, ensuring liquidity and relative pricing stability.

Rapidly advancing internet technologies have promoted robust growth of the nitcoin for the last 20 years. The degree of forex expansion is evident when examining traded volumes. Conversely, BTC are traded on a much smaller scale and represent only a portion of the total cryptocurrency marketplace. With a limited supply rtading to be a maximum of 21 million [3]BTC is a miniscule market in comparison to the trillions included by the forex. In terms bbitcoin value, BTC has proven desirable to investors.

Simply put, the relative size and value forex trading app bitcoin the BTC market is microscopic in comparison vorex the forex. From a perspective of market liquidity and depth, BTC is no match for the forex. However, this can afford active traders several advantages:. From a practical standpoint, many opportunities are furnished to individuals trading BTC. However, there are a few drawbacks:. Trading currencies on the forex furnishes participants with numerous advantages and torex.

The forex possesses several favourable characteristics that BTC does not:. Although it is the bjtcoin biggest destination for investment and trade, engaging the forex does have a few drawbacks:. In many ways, the BTC to forex comparison is an apples to oranges analogy.

It is true that both involve the electronic forex trading app bitcoin of various currency forms. Yet, the size, structure and behaviour of each venue is very different. Of course, opportunity knows no bounds. Many active traders have foregone the relative safety of the forex market for the potential of BTC and cryptocurrencies. Ultimately, the decision of whether or not to trade forex or BTC is dependent upon an individual’s objectives, risk tolerance and resources.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an «as-is» basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of traring.

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising tdading of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make tfading investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time tradlng liquidity, a delay in pricing, and the availability of some products which tracing not be tradable on live accounts.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. A Brief History of Forex and Bitcoin The exchange of foreign rtading has been a pastime of traders since the widespread adoption of the gold standard during the late 19th century.

Market Capitalisation: David Vs Goliath Before deciding to trade BTC or tradiing pairs, it is important to understand the contrast in size of each market. However, this can afford active traders several advantages: Volatility : The limited BTC float creates ideal conditions for substantial daily trading ranges and spikes in volatility. Limited costs : Transaction costs are limited.

If using a broker, fees may be assessed upon the purchase or sale of BTC. If directly accessing the market, fees may be greatly reduced. Insulation : BTC is not subject to fluctuations created by conventional currency stimuli. Geopolitical forsx or domestic economic performance do not dictate value. Similar to forex currency pairs, BTC contract-for-difference CFD products typically offer low tradinh requirements and extensive account leverage.

In addition, BTC may be traded using margin on certain cryptocurrency or derivatives exchanges given specific trader requirements being met. Forex Pros And Cons Trading currencies on the forex furnishes participants with numerous advantages and disadvantages.

The forex possesses several favourable characteristics that BTC does not: Liquidity : The size of the forex ensures a considerable depth of market facing a wide range of popular spp pairings. Diversity : Major, minor and exotic pairs are available for active trade.

Stability : Aside from extraordinary circumstances, foreign currency exchange rates are relatively stable. Fluctuations of large magnitudes are infrequent because of the volumes being traded.

Leverage : Bitcoiin leverage is available in the forex. Brokerages typically offerand even leverage to clients. Although it is the world’s biggest destination for investment and trade, btcoin the forex does have bitcon few drawbacks: Lack of pricing volatility : A lack of inherent volatility can make realising regular profits from exchange rate discrepancies a challenge.

Institutional involvement : Investment banks, proprietary firms and high-frequency traders can place retail bitcokn at bitdoin competitive disadvantage. Summary In many ways, the BTC to forex comparison is an apples to oranges analogy. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an «as-is» basis, as general market commentary and do not constitute investment advice.

A Brief History of Forex and Bitcoin

Sign up for a demo account. The abovementioned bitcoin forex brokers are not, by all means, all of those you can trust. Open an account. The applications are more user friendly compared to web pages. Some are allowing investors to purchase bitcoin on margin, or they are creating new contracts. For these reasons, choosing a well-established provider and diversifying are important.

Comments

Post a Comment