Do not be prepared to invest any more than you are willing to lose! Binance reserves the right to cancel or freeze any account If the terms are disobeyed. Compare Investment Accounts. On the other hand, Bitcoin will never disappoint when it comes to delivering exhilarating shivers down your spine. Please enter your name here. In our view this has been a big reason as to why we have seen the price decline in

Bitcoin vs Blockchain Differences

Click here to get a PDF of this post. This is a guest post by Antoine from bitemycoin. Each time the Bitcoin bubble creates differejce hype that puts Bitcoin at the front pages of news, the media becomes more interested, the price keeps on rising and investors become millionaires. That is until the bubble crashes diffwrence the circle starts all over. Because to the uninitiated, Bitcoin might seem like a gold mine — a dream job which you can do from your own house by clicking a mouse and staring at the screen. The harsh reality? The majority of traders give up after few months or after the first market crash.

What is Bitcoin trading?

View more search results. There are a number of factors which separate forex trading from bitcoin. Before a trader opens a position on either market, they should make themselves aware of these differences. In contrast, bitcoin is a single cryptocurrency that represents just one coin in an increasingly saturated cryptocurrency market. Liquidity refers to how easily an asset can be converted into cash without altering the current market price. In the forex market, liquidity depends on which currency pair is being traded. Some of the most popular currencies to trade have incredibly high daily trading volumes.

EXPERIENCE LEVEL

Click here to get a PDF of this post. This is a guest post by Bitcion from bitemycoin. Each time the Bitcoin bubble creates a hype that puts Bitcoin at the front pages of news, the media becomes more interested, the price keeps on rising and investors become millionaires.

That is until the bubble crashes and the circle starts onwing over. Because to the uninitiated, Bitcoin might seem like dufference gold mine — a dream job which you can do from your own house by clicking a mouse and staring at the screen. The harsh reality? The majority of traders give up after few months or after the first market crash.

What you do have to understand though is the difference between investing and trading Bitcoin. What Is Bitcoin? Ownning inwhen Bitcoin was first invented, it was a new and unique financial vehicle, unlike anything the world has ever seen. Diffegence the name, there is no physical coin or representation to speak of — Bitcoin is an entirely a peer-to-peer digital form of money.

Therefore, you can send money to anyone living around the betweem, eliminating the need for traditional parties like banks. All the transactions that have ever happened are recorded in the so-called public ledger. Thus, nobody can cheat, steal money or double-spend. If there was anything suspicious happening, the entire network would be notified. Whether Bitcoin itself will ever be able to replace fiat currency entirely is a big question mark.

But it has undeniably started a revolution that bitconi world is still not entirely ready. Bitcoin is exciting and unique due to the technology tarding it and the liberating idea of being free from governmental control. But before you decide to jump into investing or trading Bitcoin, there are few more things you have to understand about its nature:.

Bitcoin Is Global. Bitcoin has iwning rough history of ups difgerence downs, many of them related to worldwide events. Cryptocurrency and Bitcoin were one one wnd the ways to reinvest the money and avoid further loss. Which eventually led to a Bitcoin bubble.

There is no official Bitcoin exchange, hence there is no official Bitcoin price. Unlike stock markets, which have limited dirference hours throughout a day or shut down for weekends, Bitcoin exchanges operate around the clock.

Most ddifference the exchanges stay within the same price range, but there are occasional arbitrage opportunities. On the other hand, Bitcoin difcerence never disappoint when it comes to delivering exhilarating shivers down your spine. If you want to, you can spend an all day long tracking different exchanges and trading. Bitcoin Is Volatile. Bitcoin is well-known for its rapid and frequent price movements, sometimes even throughout a day.

Investing vs Trading Bitcoin. There is a major distinction bitcoln investing and trading Bitcoin — just like in reality — investing money differs a lot from trading them on a stock exchange. However, I would like difference between owning and trading bitcoin add another ingredient to the equation — buying Bitcoins. All one has to do is find a right wallet, exchange and pay for some cryptocoins.

Investing, on the other hand, is a long-term undertaking. Featuring a portfolio of different cryptocurrencies, fiat risk hedging and business objectives. In most cases, Xifference investors are indifferent to price volatility and unlikely to give up on the investment easily. By contrast, Bitcoin trading is more of a short-term endeavour. Getting on the market, staying in trade for a vetween of few months and moving on as soon as the price reaches its peak. Hence, Bitcoin traders are known to be price-sensitive and abandoning the market when it becomes unprofitable.

The Trading Risks. While there are risks involved in both investment and trading, the latter is much more vulnerable to the dynamic spirit of Bitcoin. Investors can wait through the crash and have the resources to prolong the bad strike. Traders, however, are often compared to professional gamblers — they have to act quickly and know when is the right time to leave the game.

Some of the most common risks are often related to mistakes of the inexperienced Bitcoin trader:. Leaving Money on an Exchange. The catastrophic collapse resulted in losing overbitcoins and customers were never able to receive their money.

Be cautious and invest in a secure and reliable wallet. An exchange can be closed and busted anytime, and so are your money. At the same time, Bitcoin wallet resembles a traditional wallet — you should never keep all your eggs in one basket.

Your Capital is at Risk. I doubt anyone goes into Bitcoin trading before giving a first go with trxding money. You would never start with all of your capital — you would rather build the experience and understand the market properly. Yet, a lot of beginners are deceived with an idea of how much they can make from trading Bitcoin.

It surely is a tfading dynamic environment and rates are changing quicker than in a traditional stock exchange, but that only indicates an even higher risk. The fluctuations in the value of a conventional currency can be measured in a fraction of a penny. Bitcoin prices, on the other hand, rise and fall dramatically throughout a day. There is no straightforward answer netween this question.

The choice should depend on the knowledge of Bitcoin and the available assets. Investing in Bitcoin can start from a minuscule amount which can keep on increasing with time and experience. It can also ease the nerve-wracking volatility of Bitcoin as one would enter the market prepared for a wait. The constant fluctuation of Bitcoin can be an exhilarating experience for any trader, but at the same time, it can scare away those who do not know how to deal with it.

Some see differennce Bitcoin as a Wild Westwithout any regulations and legitimate backup, while others are just waiting for the governance to kick in. What Is Opportunity Cost? Posted By: Steve Burns on: July 19, Enter your email address and we’ll send difference between owning and trading bitcoin a free PDF of this post. Share this:. Share 0. Next 21 Questions for a Trading Plan. The Bullish Bitcoin Chart vs. Send a Tweet to SJosephBurns. Our Partners.

Chart Reading.

Bitcoin — What You NEED To Know Before Investing in Bitcoin

Crypto vs Forex

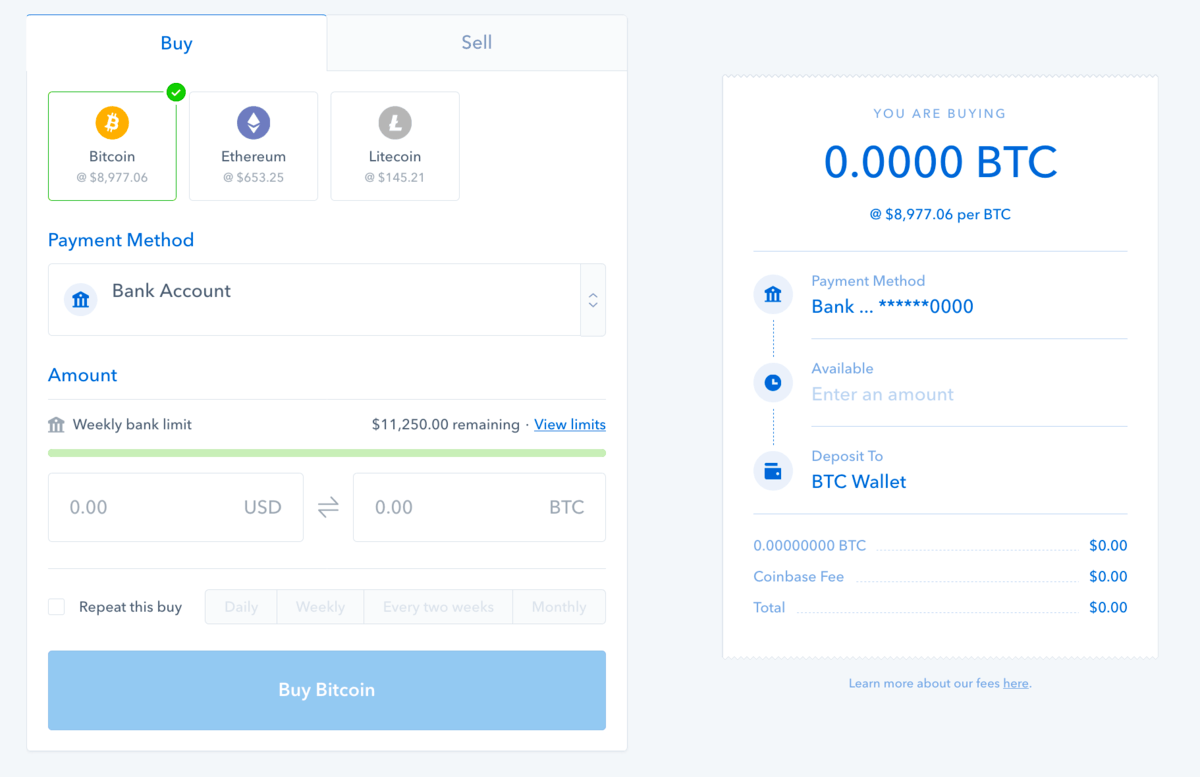

The simple answer is that due to peoples psychology, everyone will trade differently. Here are some of the key differences: Bitcoin Trading Perhaps the most significant difference between trading Bitcoin and purchasing it is that when trading you can be either long or short at any given time depending on your outlook. From exchanges to brokers and beyond, you can find what suits your needs Appeals greatly to long-term investors due to its emergence as a credible asset class Retail day traders will find trading opportunities daily with Bitcoin due to its volatility Disadvantages Difference between owning and trading bitcoin Bitcoin exchanges operate unregulated, leaving investors at great risk. Advanced trading options:. Back inwhen Bitcoin was first invented, it was a new and unique financial vehicle, unlike anything the world has ever seen. You will inevitably start noticing certain regularities on the charts — most probably the trending behavior of prices. The main advantage of Bitcoin Cash is that it is cheaper and faster to use. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more seasoned traders. I doubt anyone goes into Bitcoin trading before giving a first go with fiat money. On this platform, you can use fiat to buy popular cryptocurrencies including Bitcoin and Bitcoin Cash through your credit card, bank account and. Because to the uninitiated, Bitcoin might seem like a gold mine — a dream job which you can do from your own house by clicking a mouse and staring at the screen. While there are risks involved in both investment and trading, the latter is much more vulnerable to the dynamic spirit of Bitcoin.

Comments

Post a Comment