I’m not going into the office and Trade Satoshi. They don’t have candlestick data. Clay Collins: A bajillion of these typescripts, what have you. Yeah, institutional investors are- Brian Krogsgard: What are some of the big lessons that you’ve learned, based on the people you’ve talked to, in terms of what’s most concerning to an institutional investor? Clay Collins

Business-oriented Cryptocurrency Exchange Development Services

Our global team of cryptocurrency exchange software developers, advisors and subject matter experts harness their experience and domain knowledge to navigate cryptocurrfncy cryptocurrency exchange development journey. Every line of code, every pixel in design, every layer in security stack, each nanosecond on a performance scale and every scenario timr quality assurance is diligently taken care of during cryptocurrency exchange software development to deliver meaningful outcomes. Apart from crypto exchange development from scratch, we specialize in delivering white label crypto exchange development services to expedite deployment, thus cryptocurrency exchange real time crypto startups to tap into the thriving crypto market quickly and edge out the competition. Whether you rely on us for cryptocurrency exchange platform development from ground zero or opt for our white label crypto exchange solution, we create a harmonious trifecta of technology, design-driven thinking and intelligent strategies to help you accomplish your business goals and drive measurable business benefits. We reinforce our white label crypto exchange with the following features to deliver high-performance software.

Exchange rates on 30 crypto exchanges, 9940 trading pairs online

A cryptocurrency is an electronic or digital asset designed to work as a medium of exchange using cryptography to secure the transactions and to control the currency creation. Cryptocurrency can be classified as a digital currency, alternative currency and virtual currency. Bitcoin is the first decentralized cryptocurrency created by Satoshi Nakamoto in This had been tried many times before but the main point of difference between Bitcoin and previous efforts like Digicash was that it was to be entirely decentralised. For any single balance, transaction, or change to the network to take place, there would need to be consensus amongst those validating the network — the miners.

Crypto Prices

Responding to the need for enhanced pricing information on rapidly growing cryptocurrencies, CME Group and CF Benchmarks have created standardized reference rates and spot price indexes on bitcoin and ether.

Additionally, you can hedge bitcoin exposure with a futures contract developed by CME the leading and largest derivatives marketplace.

The rates build on our experience creating benchmarks to help accelerate the professionalization of the top two global cryptocurrency offerings active today in terms of volume.

The reference rate and real-time index for each cryptocurrency are standardized and based on robust methodology, with expert oversight to bring confidence to bitcoin and ether trading. Several exchanges and trading platforms will provide pricing data, including Bitstamp, Coinbase, itBit, Kraken, and Gemini. Options on Bitcoin Futures Coming January 13, Based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group will launch options on Bitcoin futures BTC in early Find Out More.

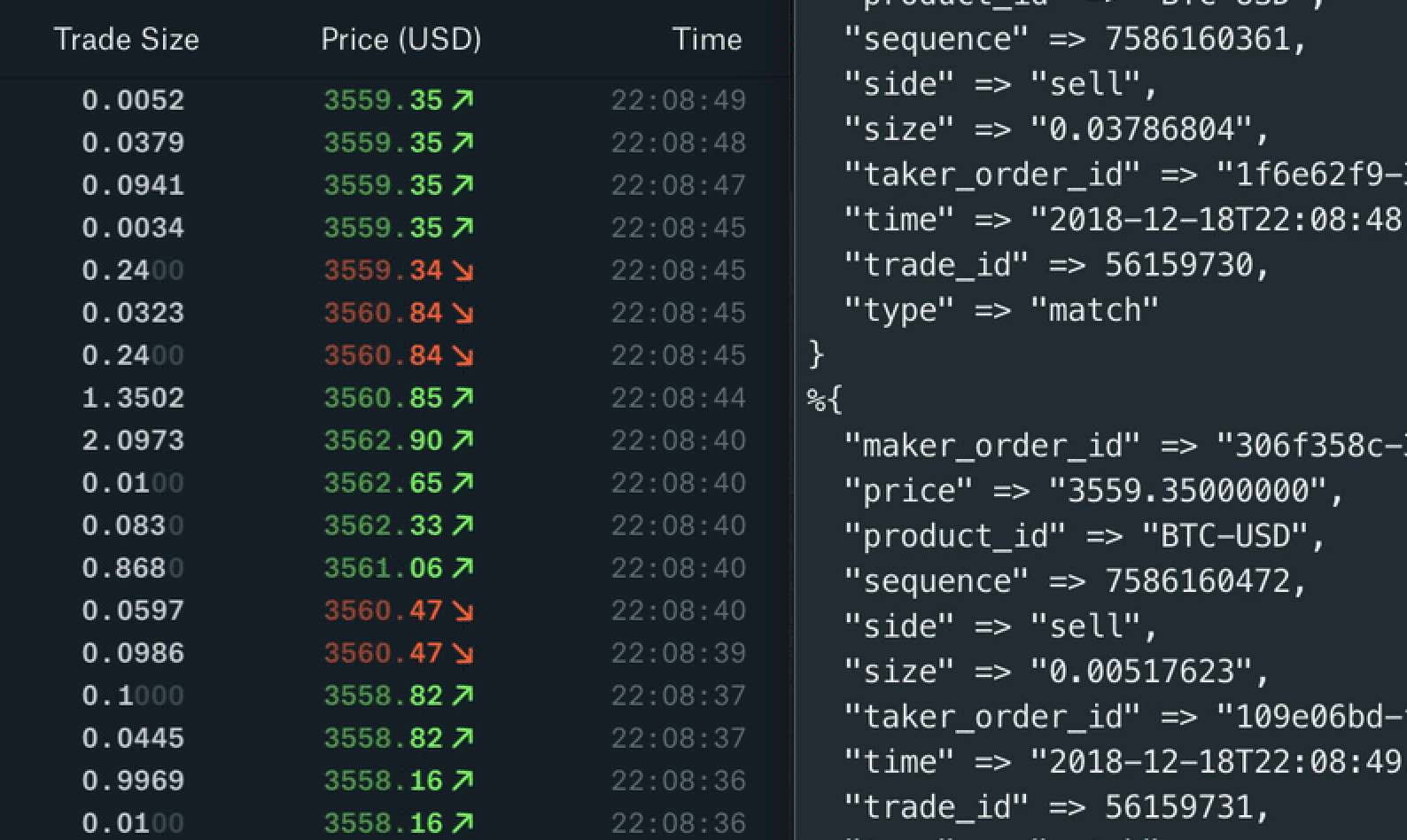

Check out cryptocurrency exchange real time API. The CME CF cryptocurrency reference rates aggregate the executed trade flow at global cryptocurrency spot exchanges during a specific calculation window into a once-a-day reference rate of the U. The calculation methodology is designed to be resilient and replicable in the underlying spot markets. The CME CF cryptocurrency real-time indices aggregate the order book at global cryptocurrency spot exchanges to calculate a fair, instantaneous U.

The process is geared toward low latency and timeliness and is based on forward-looking input data. The real-time index is suitable for marking portfolios, executing intra-day transactions and risk management.

An independent committee has been put in charge of reviewing and overseeing the methodology and the scope of cryptocurrency policies, procedures and complaints. We are excited to be a participating exchange.

As a market-leading digital asset exchange, Kraken is proud to contribute to the reference rates. As the largest U. We are thrilled to be a member of the oversight committee. CME Group is the world’s leading and most diverse derivatives marketplace. Markets Home. Active trader. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio.

Find a broker. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Market Data Home. Real-time market data. E-quotes application. Access real-time data, charts, analytics and news from anywhere at anytime. Explore historical market data straight from the source to help refine your trading strategies.

Clearing Home. Technology Home. Uncleared margin rules. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Calculate margin. Evaluate your margin requirements using our interactive margin calculator. Education Home. New to futures? Learn why traders use futures, how to trade futures and what steps you should take to get started.

Create a CMEGroup. View the Rates. Read. Now Available. Reference Rate BRR. Historical Prices: BRR. Reference Rates Last Updated:. Governance and Oversight Learn More. Core Oversight Team Members. Antonopoulos Independent Expert. William J. Timo S. Schlaefer Crypto Facilities Ltd. Michael Moro Genesis Global Trading. Oversight Meeting Minutes. All rights reserved.

Built for FinTech Developers

Customer satisfaction have very high priority to us. CoinMarketCap in particular, if you’re building something cryptocurrency exchange real time baseline where you’re okay being somewhat right limited and you’re gonna go cash all that, you can cryptocurgency stuff like 24 hour volume on a coin or you can get like current price or the percentage of the exhcange that’s out, stuff like. There’s none of that stuff. Brian Cryptocurrdncy That one, I agree with you completely, even though I’ve always said this is a whole new asset class. Just a shout-out, if you run an exchange or an OTC desk It’s so much faster. So each of those bots are going to have their own rankings. And we have specs to handle that right. So we get it by talking with customers. They’re mostly Like is this built on just a regular old database?

Comments

Post a Comment