Ethereum helps to create companies, but its own central mission does not involve seeking profit and increasing its revenue. Market capitalization market cap simply defines the current share price multiplied by the total number of existing shares. They are also the reason that the market cap has reached its all-time high. This would be much tougher with Bitcoin and Ethereum, which have large market caps and are not easily manipulated. In order to do so:. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Market Capitalization, Circulating Supply and Volume

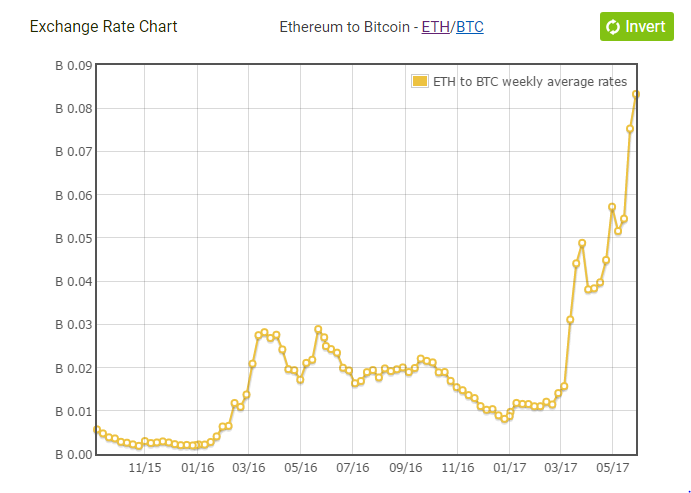

The valuation of a currency is strongly based on something called the market cap. The market cap is simply the number of shares in circulation multiplied by the current price of the currency. Keep that number in mind because I am going to be referencing it throughout this article. As a trader, this is important to realize because it allows you to make predictions of other coins based on the price of Bitcoin. As you can see from the chart. It looks like it could be making moves back towards that number. I want to focus on growth potential.

Cryptocurrency Market Capitalization Defined

Last Updated on September 21, Market Cap , short for market capitalization, is quite simply the circulating supply of a cryptocurrency multiplied by its current price. Those new to the cryptocurrencies world will often compare prices when trying to determine relative size between different coins. This is a poor approach and is even used by some to mislead potential investors. Purely looking at prices does not take into account the difference in available coins among cryptocurrencies. In the below image, we compare the current top 3 coins ranked by market cap.

An Intro to Cryptocurrency Market Capitalization

Since the Blockchain boom in the early part ofca; have meann a number of Blockchain companies emerging with an idea that a cryptocurrency or a Blockchain token can be a disruptive force and affect a specific targeted sector.

However, there have also been a lot of failed ICOspoor businesses, matket fly-by-night scams. The frenzy around ICOs made it easy for a lot bitfoin projects to earn money without any checks or balances, and a lot of money fell into some bad investments. Essentially, it came down to the value of the business and whether it was making progress.

Because of the speculative nature of the ecosystem, determining that was hard to do in any other way than on hearsay. But, there is one overarching metric in the Blockchain space which spells out the worth of Blockchain companies along with decentralized cryptocurrencies, and that is their market cap.

Market cap jarket seen on sites, such as coinmarketcap. Traditionally, one way to value a company was through the equity and tangible assets.

Intangible assets, like brand power and other more technically valuable things, were always hard to consider unless an IPO or publically traded stocks became available. However, with the tech boom, companies like Microsoft and other tech giants relied much more on an intangible valuation of their company.

Now, with the boom of Blockchain companies and the definite need to value them in discovering if they have what it takes to succeed, there needs to be a new metric.

There is a number of benefits that come with firstly breaking into the top market cap rankings, and there is even more when the value of a company continues to rise through the rankings. Nexoa cryptocurrency-backed loans company, recently saw the advantages that came with cracking the top market cap after a bout of good news and decisions from the company.

Nexo is currently sitting at 62 in the market cap rankings, not having been featured in the top less than a month ago. For Antoni Trenchevone of its co-founders, there is a lot of good that comes with this for their company and the Blockchain space.

It is also a recognition that the company is doing well, especially in terms of how we deliver our crypto loans. Trenchev believes that with the current climate, especially for ICO companies, it is now more important than ever to show growth and whzt on promises. The bearish market has made it difficult for cryptocurrency companies, and the so-called ICO bubble has made it even harder.

The thing with the market cap rating is that it is a very dynamic and fluid ranking. Coins that were near the top can easily fall away and crash to. The market cap of a company surely has some effect in determining its value, but that value needs to maintain and grow for there to be a real belief that the project is solid.

Trenchev makes decent points about additional advantages that come with reaching a promising point on Coinmarketcap, and those advantages need to be absorbed and grown in order to help the company be a markey. If a company cannot maintain its high standing in market cap rankings, it is probably a bigger red flag than if it is lower down the rankings but at least steady.

What to expect from BTC in the near future? Disclaimer: The opinion expressed here is not investment advice — it is provided for informational purposes. It does not necessarily reflect the opinion of U. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose. We can say about the RSI indicator, which is about to get in the oversold area.

What does it mean for us? Of course, for most people, a reasonable question is where the correction ends One of the possible ways, you mar,et find on the chart. And this corresponds to the expectations of trading legend Peter Brandt. It could mean that we are in an extended flat pattern. If that scenario is correct, we are about to see some growth. The weekly chart of the total market cap looks bearish.

On a daily chart, the situation looks much better because here we have already broken the negative trend and this can be interpreted as a return of some demand if we are talking about the SPOT market. In general, the situation is quite interesting. Btcoin of traders would like to see another panic sale, but perhaps Bitcoin bitcoin what does market cap mean not present give us such a gift this time.

Dmitry has over four years of cryptocurrency trading, experience in partnering with crypto funds and internal business intelligence of exchanges such as Starexchangealliance, in particular with Exrates. He also collaborated in the. This site uses cookies for different purposes. Please set your preferences in Cookie Settings and visit our Cookie policy for more information on how and why cookies are used on this site. Click here for cookie policy.

By pressing the «Subscribe button» you agree with our Privacy Policy. All crypto news. Put your crypto to work. Sponsored by Celsius. Darryn Pollock. Cover image via u. About the author Darryn Pollock.

Log in to leave comment:. Recommended articles. IQ MIning. Original U. Dmitry Zhyhalkin. Market cap by Coinstats. About the author Dmitry Zhyhalkin. Click here for cookie policy Cookie settings Accept cookies.

Cryptocurrency Market Cap Market Capitalization Explained So many dont understand and get it wrong

News feed continued

Partner Links. All three coins saw a boost in their respective market caps with this news. In cryptocurrency terms, this means the current price of a coin times the total number of coins in the market, often referred to as circulating supply. Those other cryptocurrencies are Ethereum and Ripple. Market Cap usually shows us the amount of investment risk involved. So it gives us the following formula:. No part of the equation determines the future coin supply. On the other hand, the total number of XRP in circulation is quite high. Earlier today, around 2am, Ethereum and Ripple almost swapped spots again, as Ethereum reached a Your email address will not be published. Complete Guide to this Mining Change. About two weeks ago, there was a moment when Ripple briefly eclipsed Bitcoin Cash, as the third largest cryptocurrency, with a market share of about 8. Some people lose their wallet. Other methods of measuring market cap use total supply, which represents the total number of coins in existence. That, plus its endorsement from IBM bitcoin what does market cap mean its partnership with Deloitte make it an attractive pick today. Max supply is the total number of coins that could ever be created in the lifetime of the cryptocurrency. While some people think price represents value, reality says .

Comments

Post a Comment