Bitcoin futures trading is available at TD Ameritrade. Ernie Tremblay. So to buy or sell put options, or to buy a call option, you need to deposit U.

What Are Cryptocurrency Options?

Optlon Bitcoin markets have progressed quite a bit over the past few years, there is one aspect that has not gained enough traction as of. This is unfortunate mainly due to the fact that Options are a great way to trade assets that exhibit high levels of volatility. They are also ideal instruments to use for managing the risk in a portfolio. Before we can take a look at some Bitcoin options, we have to give you a quick overview of what financial options are and how they work. Options are derivative instruments that give the holder bitcoin option trade right but not the obligation to buy or sell an asset at some predetermined time in the future.

What Are Bitcoin Options?

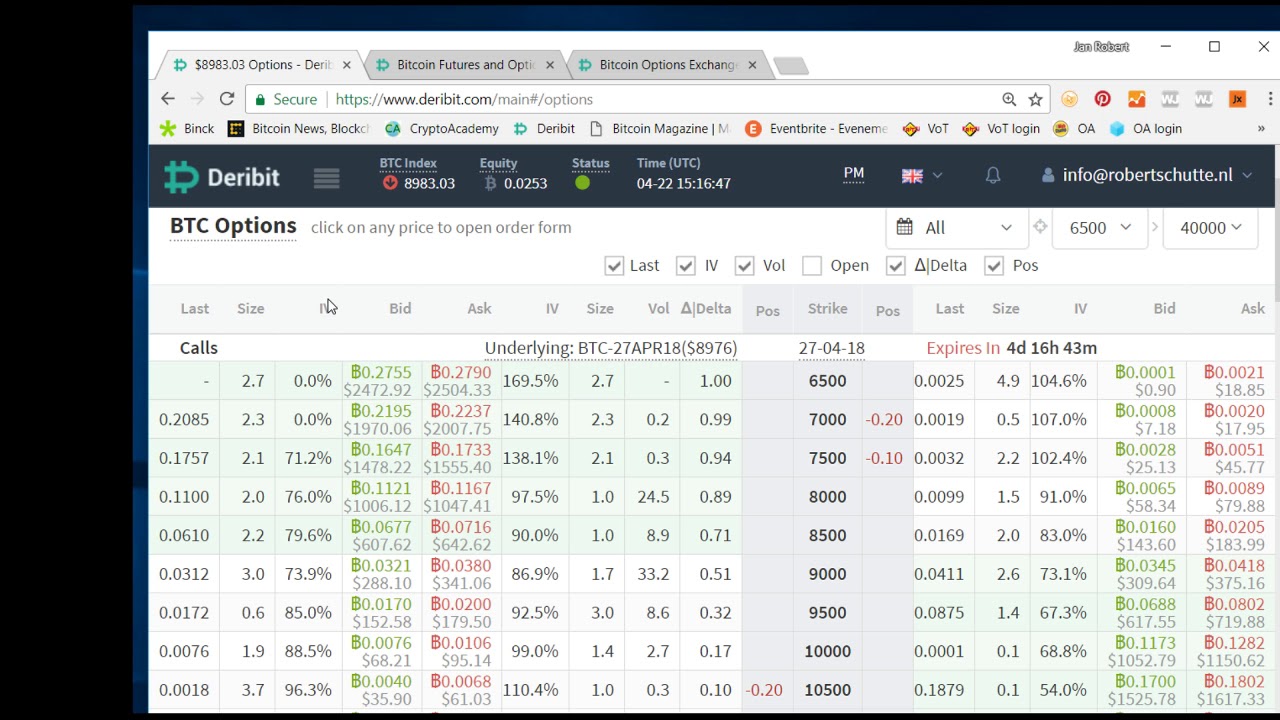

It is about buying Bitcoin Options. Buying Options is a limited risk trade. Deribit has no Options Calculator on its platform. Part 2 will treat the subject of selling options, also known as writing options, which is much riskier than buying them and carries unlimited risk. It will also take a look at Options strategies, and delve into the Greeks.

Bitcoin futures trading is here

With Bitcoin making new all-time highs seemingly everyday, the hype and buzz about the digital currency is palpable. Technically, the answer is yes. Deribit is the only liquid options exchange for bitcoin in the world. We conducted a full r eview of the Deribit platform.

There is no bitckin process. Because Bitcoin has had very wild price swings, high levels of implied volatility make sense. What this tells us is that market participants are uncertain about the direction that BTC will trade, and by how much it will trade in said direction.

Hence, they are willing to tradf a premium trxde implied volatility to protect their positions. However, because these option prices are generated by an unregulated cryptocurrency exchange, it cannot be in essence fully trusted.

Due to the immense surge in popularity of cryptocurrencies in general, LedgerX was recently approved to become the first regulated digital currency options exchange and clearinghouse in the United Bitcion. This is exactly how stock options started out in the US, especially weekly options, and bitcoin option trade optuon became one of the fastest growing financial instruments, in terms of popularity, in the world. Read all about how to trade bitcoin futures. Like the approval for options trading, the fact optoin futures trading for Bitcoin is in the works is also a huge deal.

The more ways there are to trade BTC, the bitcoin option trade opportunity there is. As cryptocurrencies begin to catch grow in popularity, we eventually foresee a world where they will be heavily traded by institutions and retail investors alike around the world.

The fact that futures and options trading will now be permitted and regulated in the US for Bitcoin is a massive step in the right direction for the future of all digital currencies. Go to tastywork’s site and trade bitcoin futures. Go to Deribit’s site and trade bitcoin options. Bitcoi There Options for Bitcoin?

August 8, Options Bro August 8, Regulated Options for BTC Are Coming Very Soon Due to the immense surge in popularity of cryptocurrencies in general, LedgerX was recently approved to become the first regulated digital currency options trase and clearinghouse in the United States. This is a huge deal for all cryptocurrency traders, especially bitcoin and ethereum. Categories: Trending.

August 5, Kevin Ott. July 18, Kevin Ott. July 13, Kevin Ott.

(How to) Hedge your Bitcoin gains using Deribit Options : Derivatives exchange

Options 101

The transaction So bitcoun Sept. The contract seller collects the premium paid up front but is exposed to unlimited losses if the trade goes against. Although Bitcoin options can provide excellent investment opportunities, they also come with a unique bigcoin of risks and drawbacks, that may make them unsuitable for some investors. As previously mentioned, options contracts come in two main varieties — calls and puts. Investors must be very cautious and monitor any investment that they make. Retirement Tips.

Comments

Post a Comment