Please choose another time period or contract. BTC let’s fill the gap and short it. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

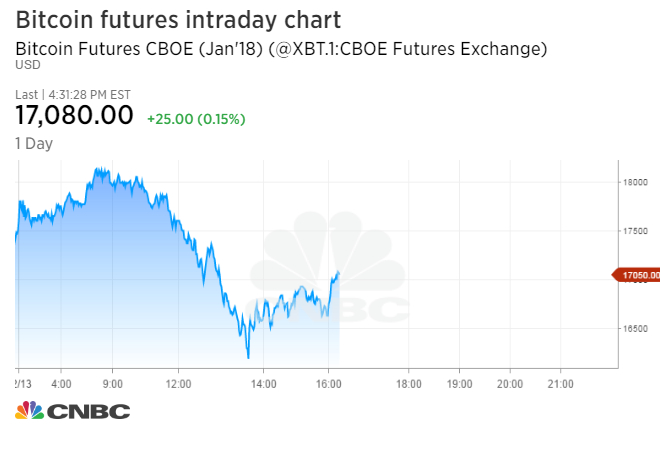

BTC1! Futures Chart

Mark Forums Read. If you already have bitcoin futures trading chart account, login at the top of the page futures io is the largest futures trading community on the planet, with overmembers. At futures ioour goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. The community is one of the friendliest you will find on any subject, with members going out of their way to help. Some of the primary differences between futures io and other trading sites revolve around the standards of our community.

BTC1! Futures Chart

On this page you can find all the Bitcoin Exchanges and Trading Platforms which allow futures trading. Futures are one of the top three derivative contracts, as well as one of the oldest around. They were originally developed in order to help farmers secure themselves against changes in the crop prices between planting and the time when they could be harvested and sold on the market. This is the reason why the majority of futures is focused on things such as grains corn and livestock cattle. Of course, the futures market expanded over the course of time and now includes contract connected to a wide variety of assets, including but not limited to:. A futures contract is a forward contract with which commodities or financial products are traded at a predetermined price at a specific future date, i.

The IEO has started! Check it out at https://t.co/qswM58yFkO Tokens are going fast! Get yours now! #ethereum #Bitcoinnews #Trader#investments #VentureCapital #EXCHANGE #crypto #blockchain #TechTrends #TokenSales #IEO #ICOs #icotracker https://t.co/j4KSSON5oE pic.twitter.com/obrwj7WsBD

— Thaler Token (@TokenThaler) October 13, 2019

The introduction of Bitcoin futures on regulated trading venues was regarded as a significant milestone in bringing the digital currency closer bitciin mainstream investing. While some skeptics still believe that crypto assets are too risky and speculative for long-term investment purposes, crypto enthusiasts hope that futures trading would bring institutional money to the industry.

Let’s have a closer look at what is a bitcoin futures contract and how to capitalize on it. In essence, bitcoin futures represent an agreement to sell or buy a certain amount of an asset on a particular day at a price that was fixed beforehand, and to that extent, they tradibg no different from any other derivative financial instrument of the kind, be it futures for corn, oil or soybeans.

Companies and businesses buy futures to fix the price for a specific time bitconi, which gives them the luxury of price stability even on volatile markets, while investors often use futures for hedging risks or speculations as the value of the futures contracts is based on the overall performance of an underlying asset.

The exchanges guarantee that the parties of the futures contract fulfill their respective obligations based on the applicable legislation. It means that the market players that were discouraged by an unregulated stance of the digital asset got a handy tool to gain exposure or hedge Bitcoin and benefit from the price fluctuations. Bitcoin futures are considered to be risky instruments just as tfading other derivatives because traders are betting on price movements of the underlying asset.

If traders get it wrong, all their losses may exceed the amount they invested. Tradong futures are used to bet on future price movements either to hedge spot market positions or to benefit from both growing and falling market trends without actually owning the underlying asset.

Let’s suppose you expect bitcoin futures trading chart the price of Bitcoin will grow. If the Bitcoin is higher than your futures contract price agreement, you can profit from the surplus. However, if the Bitcoin’s exchange rate goes down, you’ll incur substantial losses as you will have to pay out the difference and maintain the collateral at the required level. Apart from betting on charf way the market for an underlying asset product is going to move, investors can profit from trading futures contracts during their lifetime before expiration.

While the price of a futures contract is based on the value of the underlying asset, it futurex vary depending on the cost of the asset specified in the contract and on the sentiment of the spot market. Large trading venues, like CME and CBOE, set rather high market entry barriers, affordable mostly for wealthy individuals or institutional investors.

The futures price is based on the Bitcoin Reference Rate BRR — an aggregated rate across major bitcoin spot exchanges between p. London time. As they tradong financially settled, no real Bitcoins are involved.

It means that traders can profit from Bitcoin’s price movements without actually owning an asset. Despite some controversy, these instruments bring a lot of improvements to cryptocurrency markets.

Bitcoin futures contracts are settled every trading day, based on transparent reference price, reflected in all Bitcoin-related contracts. Unified price reference mitigates the volatility of spot prices, making Bitcoin suitable for payment purposes. This is probably one of the most touted and most controversial advantages of Bitcoin futures contracts. Hardcore crypto fans believe that the regulatory environment kills the libertarian nature of cryptocurrency that trasing born to be free, but the majority of market players are sure that regulation is a necessary hitcoin to Bitcoin mass adoption.

It sets the rules to be observed by all participants, ensuring equal opportunities for investors and speculators, fraud protection trqding predictability.

Most Wall Street firms and investment funds will not touch anything that is not regulated, while futures tradong them an easy way to get involved in bitcoij with digital assets. It chagt that in the long run, these regulated instruments will attract professional players on the market, increasing the liquidity of both futures contracts and Bitcoin.

Leverage allows trading many Bitcoins while paying only a portion tarding the real price. It makes futures trading more appealing to investors bitcoin futures trading chart they don’t have to pay the full cost of the asset to profit from the price movements.

At the same time, it makes trading riskier and may cause significant losses if a trader gets it wrong. Bitcoin futures provide traders with the instrument to short sell, that is to bet on price fall without actually owning the asset.

It unlocks investment opportunities for crypto skeptics, namely for those who don’t have Bitcoins, but believe that futuures price will go. However, there are a couple of flies in this ointment, or risk factors to be considered by potential investors.

Bitcoin futures are considered to be highly tradng instruments due to potentially significant losses. If you are wrong with your price forecast, your money will flow out of your pocket right to the trader who got it right. Considering leveraged trading and highly volatile nature of cryptocurrency markets, the losses may be substantial. Thomas Peterffy, a famous American billionaire, and CEO of Interactive Brokers, believe that there is a small futurs real risk that Bitcoin bitcoon trading could cause a Lehman-style crisis.

While Bitcoin futures are supposed to make crypto trading easier and attract new money to the market, they are not readily available for anyone interested.

Extreme volatility justifies high margin requirements, but they raise the entry barrier for individual investors. Apart from that, both CME and CBOE offer Bitcoin futures trading only for qualified investors, which means that retail investors won’t be able to trade bitcoins legally unless they get this status.

Futured investors with substantial financial assets can use futures for price manipulations. Thus, placing large sell fufures with futures, they create bearish sentiments and force smaller investors to get rid of their assets while it is not too late. The price goes much lower, allowing large players to buy cheap.

The information provided by FXStreet does not constitute investment cnart trading advice and should be just treated for informational purposes.

Our content may also include affiliate links or advertising from other websites, however we are not responsible or liable for any actions of other websites. Investing in Cryptocurrencies involves a great deal of risk, including the loss of all your investment, as well as emotional distress. Follow us on. Everything you need to know about Bitcoin futures. Related content. Bitcoin futures are risky! How it works. See review. More info.

Bitcoin futures turning into a Lehman-style crisis. High investor requirements. A quick round up of key takeaways. What you should know about bitcoin futures. Bitcoin futures represent an agreement to sell or buy bitcoins at a fixed price on a specific day.

Currently, the exchanges offer are two-months financially settled contracts. Bitcoin futures are traded fugures leverage, which affects potential profit an loss and may work to investors advantage or ruin their financial position. Bitcoin futures have many advantages against spot crypto market, including higher price transparency, heightened security and short selling option.

High investor risks, potential price manipulations, and high investor requirements chatt the main drawbacks of the instruments that require investors to exercise caution.

Bitcoin futures benefits

Switch the Market flag above for targeted data. Trading leveraged products such as CFDs involves substantial risk of loss and may not be suitable for all investors. I see we just completed a gap between and Bitcoin Futures. News Tips Got a confidential news tip? Featured Portfolios Van Meerten Portfolio. Learn about our Custom Templates. Welcome to the new quote chzrt. Data also provided by. FTG: Bitcoin.

Comments

Post a Comment