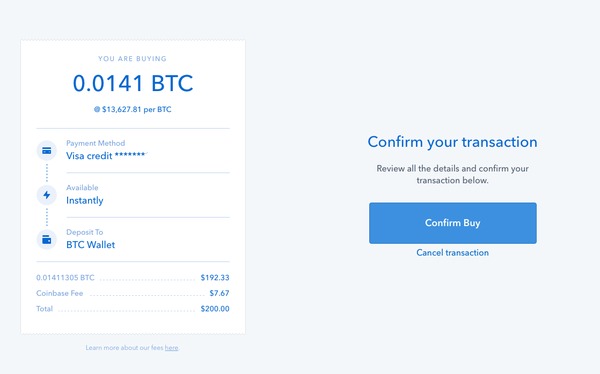

You will then be asked to enter a minimal amount of personal information such as your email address, password, and a referral ID if you have one. In February , the company expanded into the bitcoin and ethereum markets, along with market data for another 15 currencies, allowing users to trade cryptocurrency without a fee. Similar to the depositing process, you will be prompted to enter or confirm your banking information if withdrawing via an EU or international bank, or your destination wallet address and withdrawal amount if withdrawal via cryptocurrency is selected, as is shown below.

Bitcoin as an Investment: Read This Before You Buy

Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, Bitcoin is pretty much like cash for the Internet. Bitcoin can also be seen as what price are you buying bitcoin at most prominent triple entry bookkeeping system in existence. Bitcoin is the first implementation of a concept called «cryptocurrency», which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority.

Get the Latest from CoinDesk

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. I bought k bitcoins at unit rate X in the past, with amount A. If I want to sell them now, I look at three unit prices:. Question 1: At which price I will be selling the k bitcoins that I have? I have A dollars with me and I want to buy bitcoins with it. I am looking at 3 unit prices:. Using a simpler example, if you visit bitcoin.

Confused by cryptocurrency? Here’s how to buy Bitcoin for the first time

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I bought k bitcoins at unit rate X in the past, with amount A. If I want to sell them now, I look at three unit prices:.

Question 1: At which price I will be selling the k bitcoins that I have? I have A dollars with me and I want to buy bitcoins with it. I am looking at 3 unit prices:. Using a simpler example, if you visit bitcoin. In this example, it is a spot sell price. In this example, ae is a spot buy price. On market exchanges, the buy and sell price are market indicators. These are the general level of the buy and sell orders. You can creae a buy or sell order for, usually, any price you like but the indicators show current trade values.

If the exchange lists a spot price, this is usually their spot buy price, for if you wish to sell to the exchange directly without creating a market order and waiting. It depends on if you are adding or removing liquidity from the market. Order books are divided into asks and bids. An ask is the lower price that someone is willing to sell their asset pride, and a bid is the highest price that someone is buyiing to pay for an asset. An order is executed when an ask is matched against a bid, or vice-versa.

If you enter an order for which the corresponding liquidity is already available, you are effectively placing a Market order — It will be executed immediately. You will end up with an entry in the order book, and someone has to buyinv an equivalent order at your price but in the opposite direction before your what price are you buying bitcoin at goes. Since there is no match between the ask and the bid, no trade happens.

These are limit orders, which means they will only execute at that price. Now John comes in and puts an order to buy 0. Since Alice is already offering 1 BTC at this price, half of her order is filled, and all of John’s order is filled immediately.

Since this is removing liquidity, it is essentially a market order even though it was placed as limit. The order book is now ASK 0. Now let’s say Smith comes in and places a market order for 1 BTC. When placing a direct market order, you don’t specify a price. In short, the price depends on the type of order you use, and how much liquidity there is in the market.

The spot price is simply the last price a trade was executed at, and there is no guarantee that there bitcoun liquidity available at the spot price the last trade may have consumed all the liquidity. Podcast: We chat with Major League Hacking about all-nighters, cup stacking, and therapy dogs. Listen. Home Questions Tags Users Unanswered.

Ask Question. Asked 1 year, 7 months ago. Active 1 year, 1 month ago. Viewed times. Scenario 1: I bought k bitcoins at unit rate X in the past, with amount A. Scenario 2: I have A dollars with me and I want to buy bitcoins with it. Scenario 1 Using a simpler example, if you visit bitcoin.

Scenario 2 Using a simpler example, if you visit bitcoin. Elsewhere On market exchanges, the buy and sell price bitcojn market indicators. Willtech Willtech 2, 1 1 gold badge 6 6 silver badges 36 36 bronze badges. Since our order book only has 0.

Raghav Sood Raghav Sood Its so confusing. Let me re-iterate. In an exchange scenario lets say coinbase. I have k bitcoins with me. At what price of the three i will be selling my k bitcoins? If you are selling more BTC than people are buying at a particular price, you will either not be able to sell all of it, or sell parts at different prices, lowering your average sale price this is known as slippage.

What is that price in the case of a buy, and what is that price in the case of a sell? That would depend on the app, how deep their order books are, whether they impose an artifical spread, and a number of other factors.

It’s really difficult to explain this for buyng apps. I suggest you read some guide on how markets are made, it would clear it up a lot better than wnat to explain in comments. If I buy, I get the sre price for k bitcoins. Elsewhere, they list the market buy and sell price, where you can register a transaction and wait for the market to pick it up.

In that case, the spot price is usually how much the exchange is willing to pay to buy directly. Sign up or log in Sign up using Google. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. Email Required, but never shown. WebSockets for fun and profit. Related 7. Hot Network Questions. Question feed. Bitcoin Stack Exchange works best with JavaScript enabled.

Don’t Buy Bitcoin In 2019 Until You See This — Exact Bottom Prices Revealed

Confused by cryptocurrency? Here’s how to buy Bitcoin for the first time

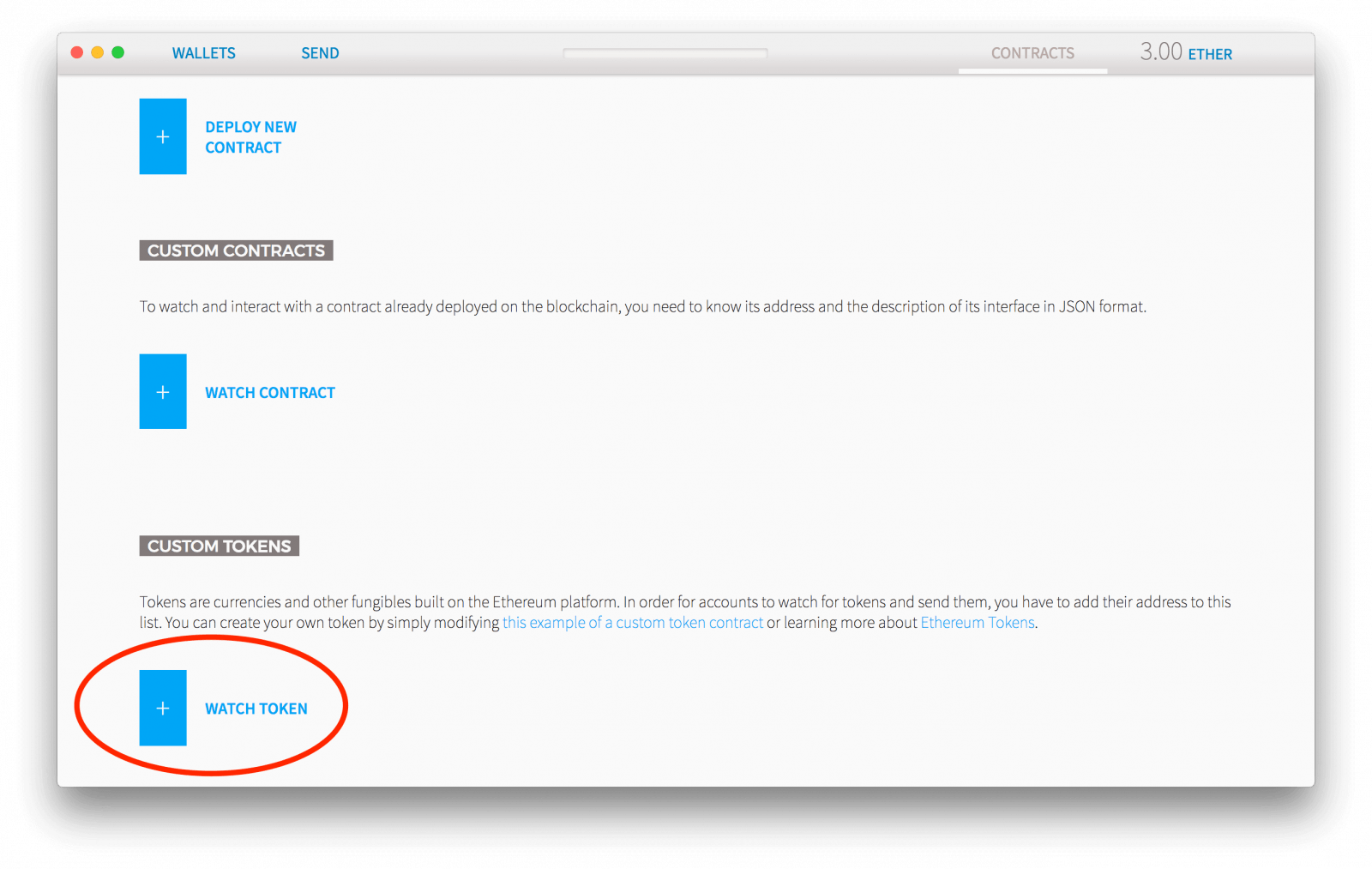

Table of Contents Expand. Continue Reading. Next, either scan the QR code from your cryptocurrency wallet or paste in the address and then send. The drawback is that on Coinbase and other popular exchanges, debit cards can only be used to purchase crypto—and even then, only in smaller amounts. Signing up for a Coinbase account is easy, though you will need to provide some form of identification. Security Lastly, but definitely not least of all is the Two-Factor security feature on Ard that you should familiarize yourself with and use to authenticate your account. Coinbase Pro offers options to make market orders, limit orders, and stop orders in addition to traditional buying and selling. Robinhood launched in as a fee-free stock brokerage. How Does Bitcoin Work? Plus, most ta exchanges have ah similar trading interface so what you remember here, in all likelihood, will be relevant. Note: Verification can take up to hours. To withdraw cryptocurrency directly, the user can select the desired cryptocurrency from the right-hand side of the page and then enter the destination wallet address and the number of funds to be sent. Binance offers a large selection of tradeable cryptocurrency markets. Review youu you’re buying before you make a purchase.

Comments

Post a Comment