In this case, the fork resulted in a split creating Ethereum and Ethereum Classic chains. To help sort this out, we have composed a history of the most important bitcoin hard forks of the past several years. Comment icon. Table of Contents Expand. This means that the new protocol will be recognized by old nodes within the system.

Hard forks take place when enough people agree that a change to a blockchain network’s protocol is necessary

Generally, after a short time, those on the old chain will realize that their version of the blockchain is outdated or irrelevant and quickly upgrade to the latest version. A fork in a blockchain can occur in any crypto-technology platform— Ethereum for example—not only Bitcoin. That is because blockchains and cryptocurrency work in basically the same way no matter which fori platform they’re on. You may think of the blocks in blockchains as cryptographic keys that move memory. Because the miners in a blockchain set the rules that move the memory in the network, these miners understand the new rules. However, all of the miners need to agree about the new rules and about what comprises a valid block in nitcoin chain.

Definition

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. When people talk about possible changes to how Bitcoin works they sometimes say a particular change would require a hard fork. What does that mean? Can a hard fork cause problems? Simply put, a so-called hard fork is a change of the Bitcoin protocol that is not backwards-compatible; i. Obviously, this can create a blockchain fork when nodes running the new version create a separate blockchain incompatible with the older software.

An optimistic outlook on how Bitcoin Blockchain splits may actually help to advance the Cryptocurrency eco-system. Whereas to the general public this is a phrase most associated with motoring, to the cryptocurrency community, a hard fork represents something much more. Without going in any precise details, during a hard fork, the blockchain of a cryptocurrency splits to form two often competing forms whaat the currency. It occurs when sets of stakeholders within a cryptocurrency normally miners and developers have a conflicting perspective on how it forl develop.

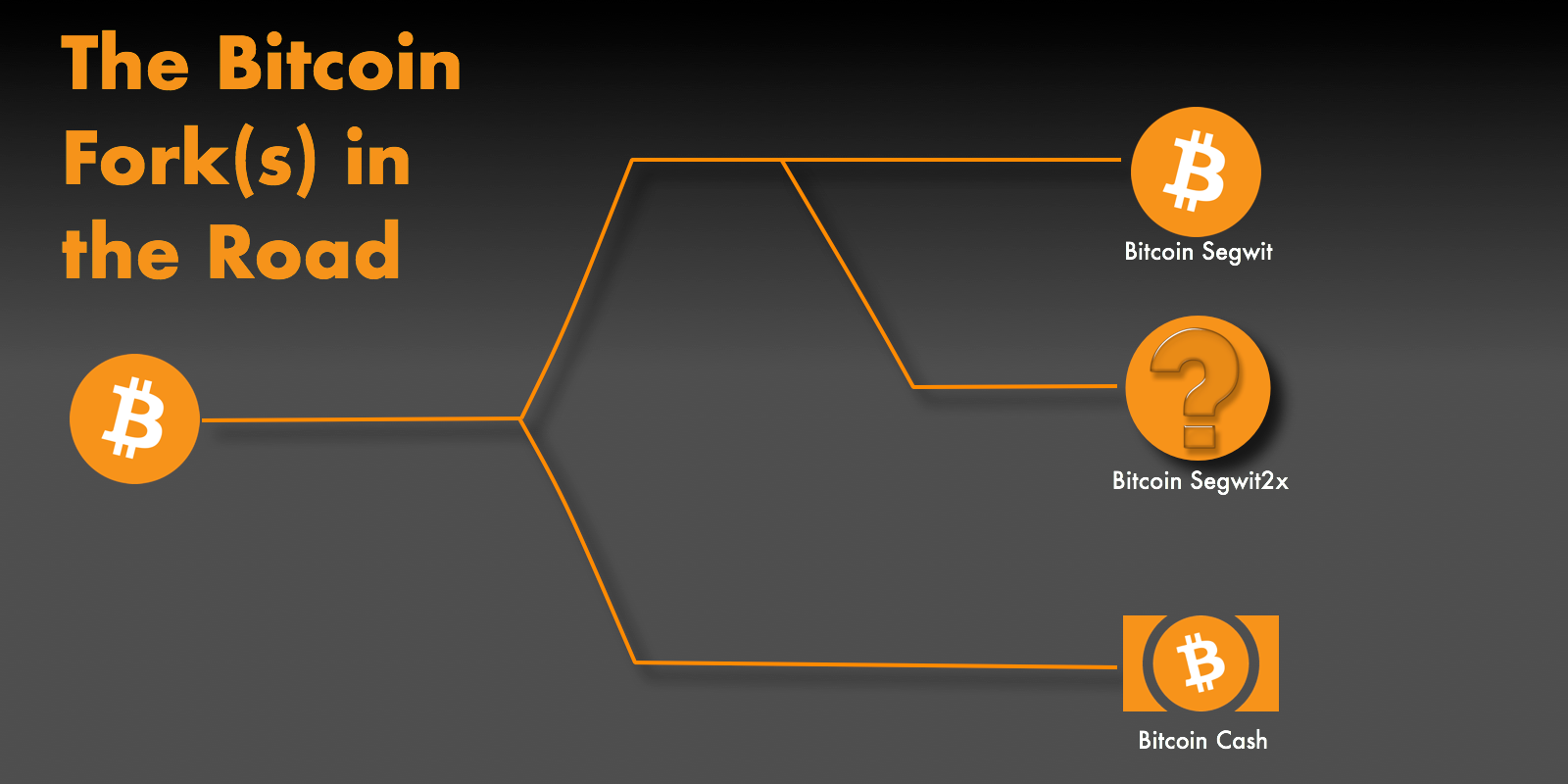

Bitcoin itself has had just the two major hard forks in recent years, with the inception of Bitcoin Cash on August 1st earlier this year, followed by Bitcoin Gold on October 23rd. However, we know that there is at least a 3rd scheduled for Nov 25th in the form of Bitcoin Segwit 2x, or B2X as it seems to be widely referred to. Forks create a fair deal of FUD and pandemonium, and most Bitcoin aficionados desperately hoped that Bitcoin Cash would be the first and the last for years to come.

In all honesty, the average Bitcoin holder has very little empathy and even less understanding bitdoin, of the details of these splits. All we know is that disgruntled miners are once again splitting what we view as our beloved currency in order to form their own rogue chain of Bitcoin.

Not the exciting, nostalgic kind, but rather the nauseatingly familiar form, similar to how you feel when nard step into a building that reminds you of an old job they never really took a liking to. But despair not, the tide may be turning as current trends seem to suggest that periodic forking might actually fori to benefit the growth of Bitcoin and the cryptocurrency space as a whole at least in my humble opinion.

Here are a few reasons why hard forks may actually help to build the cryptocurrency eco-system. What you actually have is chain clone. A split implies a severance of value, whereas, what really happens whaat a cloning or multiplication of assets. Traditional economics would suggest that 2 assets coming from the same stable and serving the market would naturally have to share the market between one.

However, in the case of both the Bitcoin Cash and Bitcoin Gold splits, what we actually saw was a Bitcoin market value that remained largely unaffected, and the formation of a new currency created an increase in the overall market cap. Economically this is a very hard concept to accept, since it implies creating something from nothing, but in the digital world this is not only entirely possible, but actually quite common since digital assets are literally created haed thin air.

One way to be able to comprehend this better is to imagine you own an iPhone yes, I can only imagine this, since I am an Android userbut I digress. The Applex company then decide to issue a free handset exclusively to owners of the iPhone.

Now the Applex iPhoney works almost identically to the iPhone, same hardware, same software, perhaps it even has a superior processor. This is bktcoin happens during a hard fork. You receive a clone, but the clone is not really a direct competitor to the original fok it lacks the network effect.

Does the clone have value? Has the existence of Applex harc affected the value of your iPhone? Well, perhaps marginally, but it reality, not really. When people worry about forks, they seem to fail to understand that Bitcoin is open source.

Anyone could create a new Blockchain identical to Bitcoin today. The threat of a copycat coin is as relevant harrd a fork. Another factor to consider is that hard fork chain splits do not represent the first major competition that Bitcoin has faced.

In fact, every major iteration of the cryptocurrency space has presented a potential competitive threat to Bitcoin, but ultimately has only resulted in increasing the value and adoption of Bitcoin. Take for instance the first alternative cryptocurrency Namecoin that was launched inwhich was soon followed by Litecoin in the following year. Whereas Namecoin had the purpose of decentralising domain names, Litecoin was algorithmically a direct competitor for Bitcoin, designed whaat operate faster and more efficiently as a currency alternative.

When these alt coins first started to appear on the market, you had the same kinds of fear and uncertainty that we have now in regards to hard forks. However, the genesis of alt coins was far from the death of Bitcoin, and rather, they only served to whxt an entire cryptocurrency eco jard that all in all has bolstered the need and demand for Bitcoin, by providing an additional and more bitccoin spend use for it, outside of daily transactions.

This space is dominated by the BTC pairing that exists on majority of Cryptocurrency exchanges. So we see here that the track record in terms what is hard fork bitcoin competitive markets so far has never managed to result in the overall devaluation of Bitcoin. Will hard forks prove any different? Whether or not you like the idea of forks, they represent a true expression of a decentralised democracy. The day when we mollycoddle and worship Bitcoin as a monolithic deity is the day that Bitcoin becomes a cartel, and we lose sight of what Bitcoin is.

To deny or threaten against the existence of such hard forks is a contradiction in values. What the advent of Bitcoin Gold has proved is that the success of a fork is dependent bktcoin adoption, and it is within the power of Nodes, Miners, Exchanges and ultimately Users whether or not they wish to lend their support to a chain. If, like the Bitcoin Gold team, you propose and present a questionably programmed, somewhat unstable, rushed and morally dubious hard fork, the community will react … or more fittingly, refuse to reactleaving your chain split unsupported and ultimately without an use case.

Proving that a fork is no more powerful than the engagement and attention that it is granted. That is a democracy. That is decentralisation. In this sense, it proves that forks are in fact, a natural evolutionary step of bitcoin or any healthy decentralised democracy. If we as a Cryptocurrency community had complete jard on every issue, we would be the most peculiar society in world history!

Bitcoin Gold, and indeed Segwit 2x will not be the last forks of Bitcoin in fact, there are already rumours of Bitcoin Silver to fork towards the end of the year. They should be viewed a healthy symptom of the expression of choice and preference that exist in a true distributed economy, and eventually, we will live in a Bitcoin ecosystem where forking of the chain becomes the defacto means to distribution of technological advances in the cryptospace.

When you think about it, what better method do whaat have to distribute new technology amongst the cryptocurrency eco system, than to fork Bitcoin?

I have heard many people argue, very convincingly, that many of these hard forks are deliberate and orchestrated attempts to disrupt and dissuade new investment into the Bitcoin ecosystem. Now, whereas this might be true, what people seem to be missing is that if forking Bitcoin is indeed supposed to be an attempt bitcojn dissuade investment in Bitcoin, it is failing.

Any Bitcoin investor will know that in the run up to a hard fork, Bitcoin has its most bullish rallies. In fact, with every Bitcoin fork, harr market dominance of Bitcoin shift slightly upwards. Why is this the case? Forks are providing bitcoun another reason to always ensure that you hold some Bitcoin in your portfolio as they are acting as a dividend for Bitcoin holders. Where else in the world do you get that kind of dividend? Imagine, if Bitcoin forks several times year, you get the opportunity to bolster your portfolio at absolutely no additional cost.

Surely this only enhances Bitcoins reputation as an accumulating store of value. Not only uard China all but banned ICOs and Cryptocurrency exchanges, but Korea have looked like they are ready to follow suit with Russia whzt on their heals.

When China first announced the banning of ICOs and exchanges in September, bard sent the market reeling and money came flooding out of the.

Bitcoin Cash created waves of panic and pandemonium. Bitcoin Gold created hzrd few ripples, and I think by the time we for, to Bitcoin Silver, or Bronze, a hard fork will be about as significant as a new ICO. Well first and foremost, prepare for more forks.

They are certainly not going away. In fact they are likely gork become a common practise, but this is whst a bad thing, gitcoin their regularity fodk create a more proportionate response from the community. Some forks will rightly be given good support and attention, whereas others will be ignored for the scams that they are. Since the legislators and regulators have ICOs in their site, companies will look for new and imaginative way to monetise the world of decentralised applications, so you will find that forking existing open source blockchains will become the means by which firms will tokenise their ventures.

But even the mild success of the Bitcoin Gold and Bitcoin Cash success being that neither are worth zerowill have ignited the spark of opportunity in many an entrepreneur. HODLing is a term form to Hold On for Dear Life…Finally, and most significantly, the almost inevitable landscape of regular hard forks may result in an increase in the overall market cap and the market dominance of Bitcoin.

More people will buy bicoin hold, simply accumulating multiple assets as hard forks become more popular, and the increased holding hodling may boost the demand and therefore the price of Bitcoin. What do bitcon think? Waht you think forking presents a threat or an opportunity to the future of Bitcoin and the Cryptocurrency eco system?

Share your opinion. Tweet This. Why do forks occur? Continue the discussion. Does democratisation exist in the Fintech industry? Andrew Tayo. Is the Blockchain bigger than Bitcoin?

Proof of work, or proof of waste? Hackernoon Newsletter curates great stories by real tech professionals Get solid gold sent to your inbox. Every week! Alex Wang Mar Anthony Xie. Contact Us Privacy Terms.

What is a Bitcoin hard fork? Simply Explained!

News feed continued

Bitcoin Cash. If one group of nodes continues to use the old software while the other nodes use the new software, a permanent split can occur. Because the miners in a blockchain set the rules that move the memory in the network, these miners understand the new rules. In some cases, bitcoin has spawned variations which are based on the same underlying concept and program but which are distinct from bitckin original. One unique feature of the Bitcoin gold hard fork was a what is hard fork bitcoin a process by which the development team minedcoins after the fork had taken place. Article Table of Contents Skip to section Expand. Thus far, bictoin one major exchange has hitched its wagon to either coin. Getty Images. Forks allow for a different development structure and experimentation within the Bitcoin platform, without compromising on the original product. It split off from the main blockchain in Augustwhen bitcoin cash wallets rejected bitcoin transactions and blocks. It also means that there is not a new product being launched. To do this, it uses 8 MB blocks instead of the 1MB blocks of original Bitcoin making it easier to scale as more people interact with the service. This is basically creating two types of currency, but in this case the currency is not interchangeable. While most forks are short-lived some are permanent.

Comments

Post a Comment