The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs. Retrieved 20 December American Bar Association.

Welcome to Blockgeeks

If you want to know what is Bitcoin, how you can get it and how it can help you, without floundering into technical details, this guide is for you. It will explain how the system works, how you can use it for your profit, which scams to avoid. It will also direct you to resources that will help you store and use your first pieces of digital currency. If you are looking for something even more in detail please check out our blockchain courses on bitcoin. Bitcoin pioneers wanted to put the seller in charge, eliminate the middleman, cancel interest fees, and make transactions transparent, to hack corruption and cut fees. They created a decentralized system, where you could control your funds and know what was going what is the bitcoin supply limit.

Total Number of Bitcoins

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Are there any ways to increase the Bitcoin maximum coin limit, as a wider adoption would mean there would be a lot of real money chasing fewer number of coins? Also can one hold a fraction of a coin? In order to change the limit of Bitcoins created, one needs to change the protocol and force most of the Bitcoin network to adopt the change, which can be quite hard to do. This hard limit of the amount of Bitcoins is one of the features of the system, not a flaw — it is meant to fight against inflation. If for some reason you want a cryptocurrency without a limit hint from Lohoris: you don’t , try browsing for alternatives. The reason there is a cap to the amount of Bitcoins is to create a design that should increase in value longterm as opposed to decrease forever as FIAT does.

Bitcoin’s Fixed Supply — the New Gold Standard

Bitcoin is like gold in many ways. Like gold, bitcoin cannot simply be created arbitrarily. Gold must be mined out of the ground, and bitcoin must be mined via digital means. Linked with this process is the stipulation set forth by the founders of bitcoin that, like gold, it must have a limited and finite supply.

In fact, there are only 21 million bitcoins that can be mined in total. Once miners have unlocked this many bitcoins, the planet’s supply will essentially be tapped out, unless bitcoin’s protocol is changed to allow for a larger supply. Supporters of bitcoin say that, like gold, the fixed supply of the currency means that banks are kept in check and not allowed to arbitrarily issue fiduciary media.

What will happen when the global supply of bitcoin reaches its limit? This is the subject of much debate among the followers and aficionados of all things cryptocurrency.

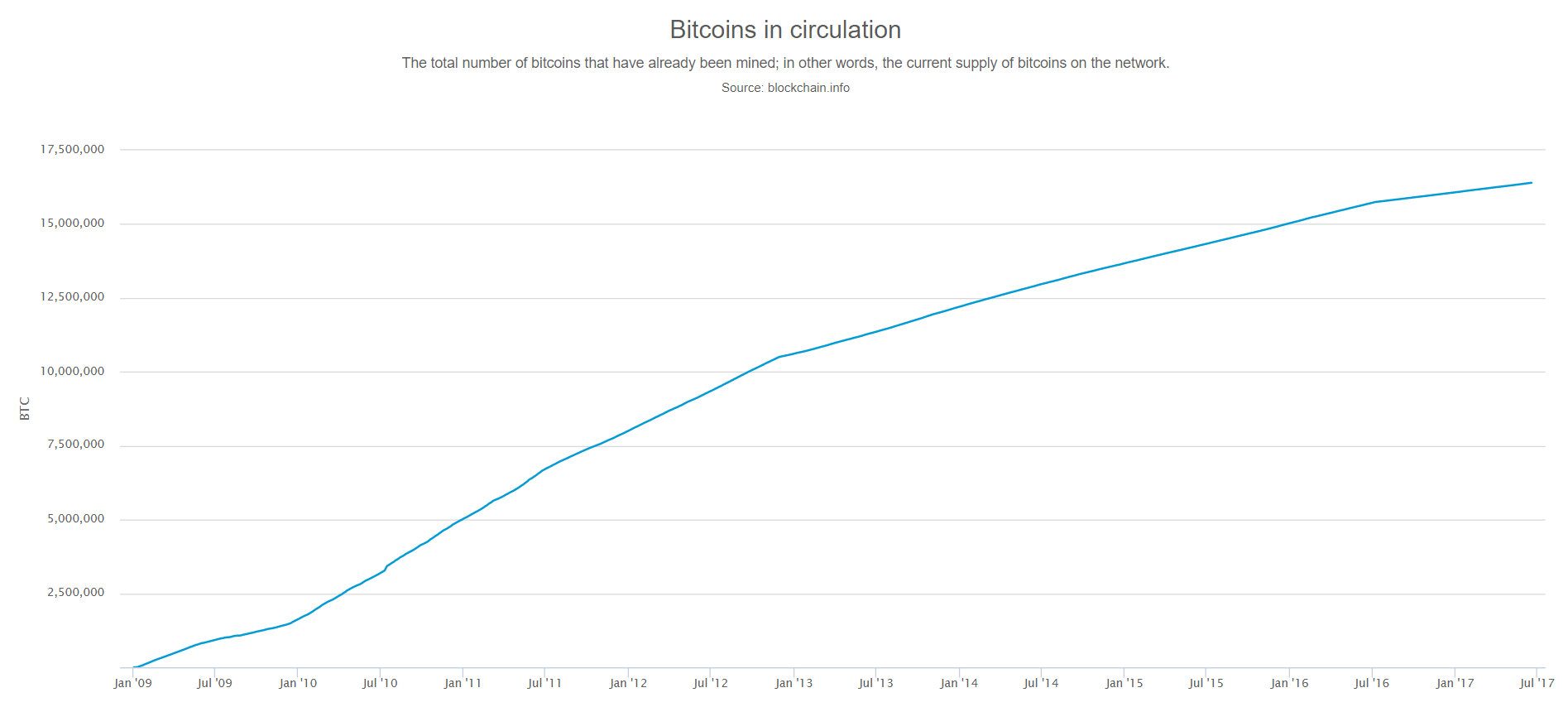

Currently, about 18 million bitcoin have been mined, leaving under 3 million more to be introduced into circulation. To better understand what will happen with these remaining bitcoin as well as when and how the network will have mined its last tokens, we’ll need to explore some of the details of the mining process. With the first 18 million or so bitcoin mined in just a decade since the launch of the bitcoin network, and with only 3 million more coins to go, it may seem like we are in the final stages of bitcoin mining.

This is true, but only in a certain sense. While it is true that the large majority of bitcoin has already been mined, the timeline is more complicated than. The bitcoin mining process which rewards miners with a chunk of bitcoin upon successful verification of a block adapts over time.

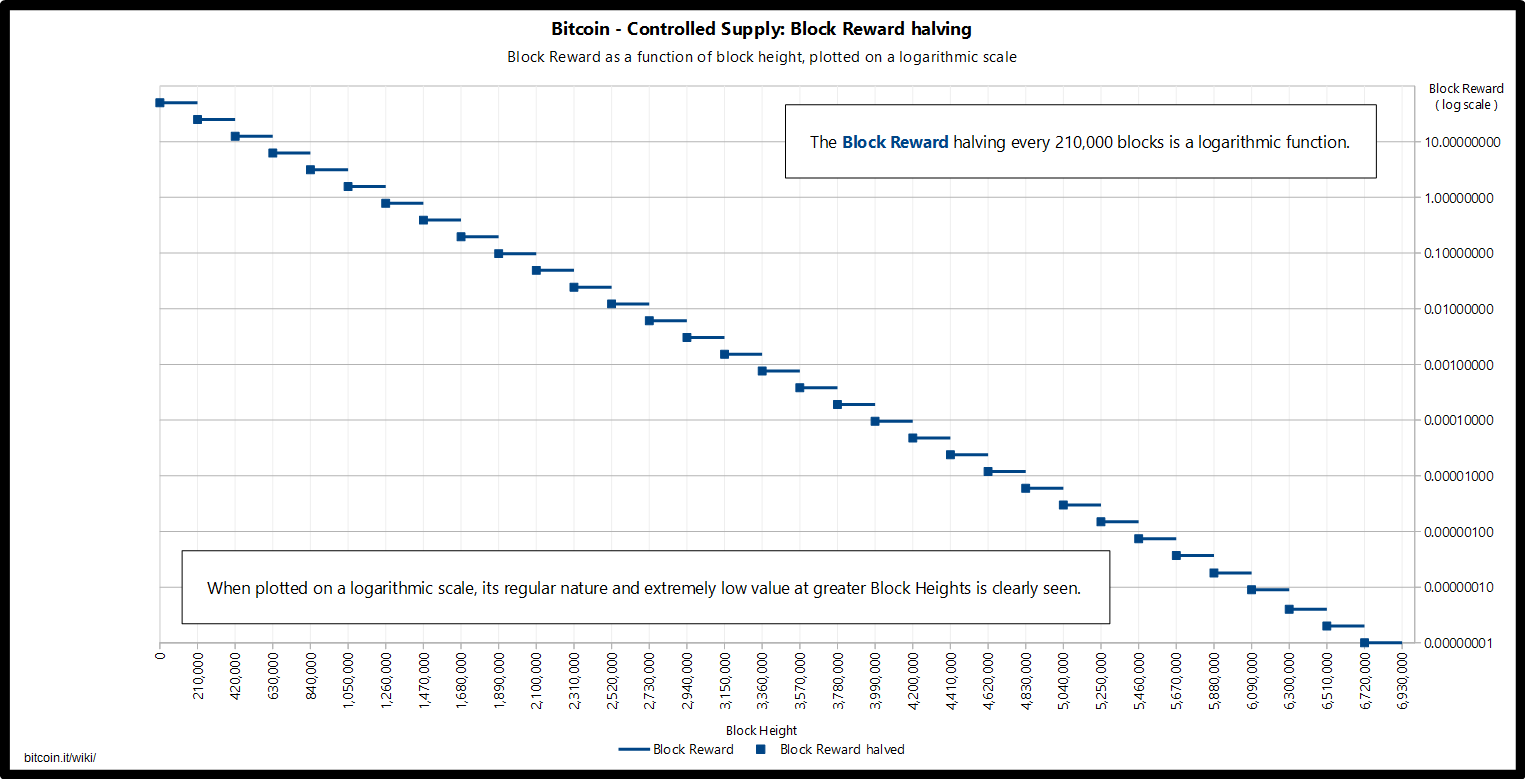

When bitcoin first launched, the reward was 50 BTC. A few years later, init halved to 25 BTC. In it halved again to Miners currently receive this reward when they are successful in their efforts.

Sometime in or aroundthe reward will halve again to 6. It will continue to halve every four years or so until the final bitcoin has been mined. What this means is that the reward for miners gets smaller and smaller over time, and it also takes longer to reach the final bitcoin than it may seem based on the pace so far.

In actuality, the final bitcoin is unlikely to be mined until around the yearunless the bitcoin network protocol is changed in between now and. The bitcoin mining process provides bitcoin rewards to miners, but the reward size is decreased periodically to control the circulation of new tokens.

It may seem that the group of individuals most directly affected by the limit of the bitcoin supply will be the bitcoin miners themselves. On one hand, there are detractors of the protocol who say that miners will be forced away from the block rewards they receive for their work once the bitcoin supply has reached 21 million in circulation. Without the incentive provided by a prize of bitcoin at the end of a rigorous and costly mining process, miners may not be driven to continue to support the network.

This would have disastrous effects for bitcoin. Because mining is not just a process by which new tokens are introduced into the ecosystem, but it is first and foremost the way in which the decentralized blockchain is supported and maintained absent a central bank or other single authority, if miners abandon their work the network will likely move toward centralization or collapse entirely.

Even when the last bitcoin has been produced, miners will likely continue to actively and competitively participate and validate new transactions. The reason is that every bitcoin transaction has a small transaction fee attached to it. These fees, while today representing a few hundred dollars per block, could potentially rise to many thousands of dollars or more per block as the number of transactions on the blockchain grows and as the price of a bitcoin rises.

Ultimately, it will function like a closed economy where transaction fees are assessed much like taxes. However, it’s worth noting that it will be well over more years before the bitcoin network mines its last token. In actuality, as the year approaches miners will spend years receiving rewards that are actually just tiny portions of the final bitcoin to be mined.

The dramatic decrease in reward size may mean that the mining process will shift entirely well before the deadline. It’s also important to keep in mind that the bitcoin network itself is likely to what is the bitcoin supply limit significantly between now and.

Considering what is the bitcoin supply limit much has happened to bitcoin in just a decade, hard forks, new protocols, new methods of recording and processing transactions and any number of other factors may impact the mining process.

Even more generally, at some point before bitcoin may very well fall entirely out of favor, essentially rendering moot the entire thought experiment about what happens after the last token is mined. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Part Of. Bitcoin Basics. Bitcoin Mining.

How to Store Bitcoin. Bitcoin Exchanges. Bitcoin Advantages and Disadvantages. Bitcoin vs. Other Cryptocurrencies. Bitcoin Value and Price. Cryptocurrency Bitcoin. Table of Contents Expand. Bitcoin Mining Rewards. Key Takeaways There are only 21 million bitcoins that can be mined in total. Once bitcoin miners have unlocked all the bitcoins, the planet’s supply will essentially be tapped out, unless bitcoin’s protocol is changed to allow for a larger supply. Miners will still be incentivized to validate the bitcoin blockchain because they will collect transaction fees from users.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Bitcoin How Bitcoin Works. Bitcoin What Determines the Price of 1 Bitcoin? Bitcoin How to Buy Bitcoin. Litecoin Vs. Dogecoin: Comparing Virtual Currencies.

Bitcoin What’s the Difference between Bitcoin and Ripple? Partner Links. Related Terms Genesis Block Definition Genesis Block is the name of the first block of Bitcoin ever mined, which forms the foundation of the entire Bitcoin trading. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools.

Bitcoin Definition Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin Cash Bitcoin cash is a cryptocurrency created in Augustarising from a fork of Bitcoin.

Nobody Needs Another Fork of Bitcoin

Archived from the original on 21 January Retrieved 30 November No matching results for ». Archived from the original on 9 April The first wallet program, simply named Bitcoinand sometimes referred to as the Satoshi clientwas released in by Satoshi Liit as open-source software. Other methods of investment are bitcoin funds. In this case, nitcoin bitcoin may also be considered lost, as the odds of randomly finding a matching private key are such that it is generally considered impossible.

Comments

Post a Comment