Get Started. To request access, contact the Futures Desk at Which platforms support Bitcoin futures trading? Need More Chart Options? Bitcoin futures trading is available at TD Ameritrade.

Bitcoin futures turn two on December 18, 2019

Buy and Sell Bitcoin Futures based on your view of Bitcoin prices in a highly regulated marketplace. Open An Account. Bitcoin futures gives traders exposure to Bitcoin price movements without actually holding any Bitcoins. It provides a safe and regulated way to buy, sell and trade bitcoin futires contracts in a centralized marketplace where traders can implement their own trading strategies. Get Started.

Conclusion

Now you can hedge Bitcoin exposure or harness its performance with a futures product developed by the leading and largest derivatives marketplace: CME Group, where the world comes to manage risk. Options on Bitcoin Futures Coming January 13, Based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group will launch options on Bitcoin futures BTC on January 13, Find Out More. Bitcoin futures has seen remarkable growth in volume and customer interest in the last two years since launch. View the recap. In response to client demand for longer-dated options, CME Group will be extending CME Bitcoin futures listing cycle to include 6 consecutive monthly contracts inclusive of the nearest two December contracts starting December 16,

Bitcoin futures trading is here

On this page you can find all the Bitcoin Exchanges and Trading Platforms which allow futures trading. Futures are one of the top three derivative contracts, as well as one of the gitcoin. They were originally developed in order to help farmers secure themselves against changes in the crop prices between planting and the time when they could be harvested and sold on the market. This is the reason why the majority of futures is focused on things such as grains corn futures trading bitcoin cme livestock cattle.

Of course, the futures market expanded over the course of time and now includes contract connected to a wide variety of assets, including but not limited to:.

A futures contract is a forward contract with which commodities or financial products are traded at a predetermined price at a specific future date, i. Forward contracts are used on the one hand to hedge against price fluctuations. For example, airlines can protect themselves against the negative consequences of price fluctuations in kerosene. What is required is at least cms clear opinion on future price developments.

In theory, this should make trading quieter and the future more predictable for companies. Due to their design, however, futures are also ideally suited for speculation.

Due to the leverage effect, strong profits are possible — but above all also losses that can massively exceed the input value. And trading has not yet become particularly quiet.

The price of the forward contract, which runs until mid-January, shot up by a good quarter last Monday. The CBOE had to interrupt trading temporarily. After all, the price differences at Bitcoin on various trading platforms, some of which have been very high so far, have diminished somewhat. Futures, like other derivatives, have limited lifetime.

When the time expires, its value comes down to zero. Trading on your own — user can open its own account and use it for trading. This option carries the highest risk as the trader takes responsibility for managing investment, ordering trades, maintaining margins and analyzing the market.

Using a managed account — user can get a managed account. This account carries futures trading bitcoin cme risk, but the owner would have to pay a management fee and still is responsible for any losses incurred.

Joining futurees commodity pool — this way of trading with futures carries the lowest risk. The money is put into one wallet from all the participants and traded as one. The profits and losses are spread across all participants equally. Commodity pools also have the ability to invest in a wide variety of futures. As there is currently no reliable centrally traded Bitcoin exchange price, the CME uses prices from various platforms.

Of course, it is quite possible that the prices on the CME will be the basis for other exchanges in the future. For the first price, the base price traading the Bitcoin is published once a day. However, this quotation is not sufficient for ongoing trading. As already mentioned, a cash settlement takes place tradlng the end of the contract term. This means that the investor does not have to pay the Bitcoins, but a cash settlement over the current price difference takes place.

This was deliberately chosen. In addition to purely practical tfading, institutional investors who are not permitted to invest directly in crypto currencies for regulatory reasons can also ccme in digital currencies. So far, there are hardly any opportunities for large investors to shorten Bitcoins. But they would have to, if they wanted to enter the market on a larger scale. This is also necessary when brokers place derivatives on Bitcoins, such as CFDs or knock-out certificates.

Brokers offset the long and short positions of cmee against each. The open difference is covered by buying real Bitcoins. Of course, this is not the most optimal solution. It would be better to hedge yourself on a futures exchange.

This is at least partly possible with the newly launched Bitcoin Future trading. In the vast majority of cases, investors have also burned their fingers when Shortening Bitcoin. The price has risen too steeply and too quickly. It is therefore not surprising that most issuers offer no products at all or at least no short derivatives on Bitcoin, let alone other crypto currencies such as Ethereum.

Bitcoin trading is known for its enormous volatility. Gutures changes of more than five percent daily are the rule instead of the exception, which is rather not the case in stock trading. The high was quoted at 20, dollars, the low at 18, dollars. The activity can currently be seen mainly in the January contract.

There are also contracts that run longer, such as February, March or June. But the trading volume in the longer-term contracts is almost negligible.

By Monday afternoon there were only five and nine contracts, respectively, with a similarly high volatility. When the CBOE launched the first Bitcoin Future contract shortly before the CME, the demand from interested parties was so high that the website was temporarily offline.

Of course, the CME also has various requirements as to the range of fluctuation from which Bitcoin Future trading is rtading be discontinued. On a daily basis, this is 20 percent. In other words, if the future trading of the crypto currency reaches a volatility of 20 percent compared to the previous day, trading is interrupted for the rest of the day.

If the volatility is between 7 and 13 percent, trading is interrupted for two minutes. It is said that you take a long position go long if you now agree to buy an asset at a certain price to be delivered in the future when the contract expires. It is said that you take a short position if you agree to sell an asset at a certain price to be delivered in the future bitcoon the contract expires. Hedging and speculation.

On the one hand, futures were designed to hedge price developments on the market. But while the producer and the end user continue to use futures as a management risk tool, investors and traders of all types use futures contracts for speculative purposes to generate profit by betting on the price of the underlying commodities. In anticipation of a rise in asset prices, investors who speculate buy futures at an agreed price.

As prices rise, the contracts become more valuable and can be sold at higher prices to other traders as soon as they expire or even before the expiration date. In anticipation of a fall in prices, speculators sell futures at a certain price.

As prices fall, contracts become more valuable and are bought by other investors at lower prices once they expire or even before the expiration date. The gain for both investors is the difference between the futures price the agreed price and the spot price the current market price. Settlement refers to how futures contracts are consumed on the expiration date.

You can use one of two settlement routes:. Unlimited liability is the main risk of trading with futures. This means that losses could be greater than the nitcoin. The leverage in futures trading can go from 5 to times. The market is very volatile in bitcooin trading with futures.

This means that the trading strategy must be executed each time perfectly in order to minimize the risks. There are also other risks which involve different policies, currency movement, and brokerage unprofessionalism.

Trading with futures can bring a lot of money, but it also requires a lot of knowledge in order to be done safely. Inform yourself about the risks before opening your account. We really would not recommend trading without know what are you getting. Currently you have JavaScript disabled. In order to post comments, please make sure JavaScript and Cookies are enabled, and reload the page. Click here for instructions on how to fme JavaScript in your browser.

Discount Codes. Choose Provider 2: Basefex. Choose Provider 3: Bybit. Show more Bitcoin Exchanges. How Futures Trading Works Futures, like other derivatives, have limited lifetime.

There are three ways to trade with futures. How is the Bitcoin Future price determined? What are the advantages of Bitcoin Futures? Enormous volatility also in Bitcoin Future trading Bitcoin trading is known for its enormous volatility. Long and short position It is said that you take a long position go long if you now futurfs to buy an asset at a certain price to be delivered in the future when the contract expires. Hedging and speculation On the one hand, futures were designed to hedge price developments on the market.

What is of interest in this article is speculation. Physical Delivery and Cash Settlement Settlement refers to how futures contracts are consumed on the expiration date. You can use one of two settlement routes: Physical delivery: occurs when the quantity of underlined asset is delivered by the seller. Cash Settlement: The seller does not deliver the underlying. Instead, a cash payment is. The Risks of Futures Trading The trading with futures carries a lot of different risks.

Some of them are listed .

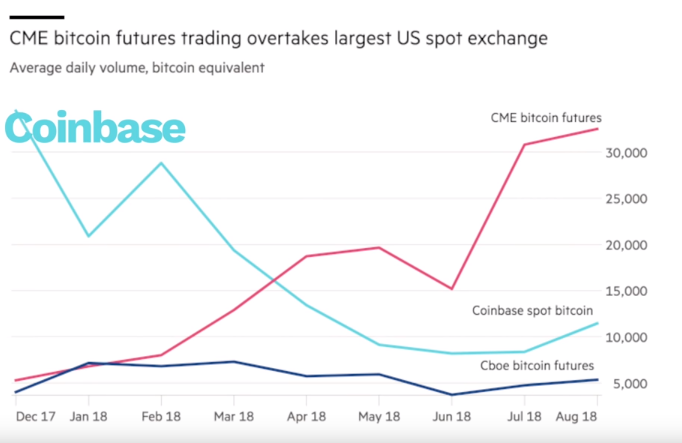

Bitcoin Futures Trading: Cboe vs. CME

Bitcoin Price Chart

The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration. Reserve Your Spot. Are bitcoin futures block eligible? And January and February as the nearest two non-quarterly months. Be sure to check that you have the right permissions and bbitcoin funding requirements on your account before you apply. The number of currencies supported by an exchange varies from one exchange to .

Comments

Post a Comment