Trading View allows you to create an account where you can save your charts. Binance Jersey. Before setting up an account, make sure to get familiar with the deposit, withdrawal, and transaction fee structure. At most exchanges, when you deposit via bank transfer you have to wait days for the bank transfer to complete. Just like Binance, they offer a fully functional mobile app for Android and iOS.

Not a member yet?

So, Cryptocurrency emerged as a side product when Satoshi Nakamoto was working to create a decentralized digital cash. His major Invention was to get general agreement without a central cryptoucrrency which almost all people working at that time was failed to. Satoshi in his published paper had proved that technically through peer to peer network it is possible to put cash system on completely decentralized platform. The cryptocurrency is the byproduct of this invention. This thrilled the world economics pillars. The cryptocurrency is a type of cryptocurrency exchanges cryptocurrency market currency generated through a special algorithm which can be worked as a medium of exchange.

Best Cryptocurrency Wallets for 2019

Slowly and steadily, Bitcoin and altcoins are getting attention from more investors all around the world. And why not? Note: This list is starting from easy to use exchanges and moving towards some of the advanced exchanges. The company is registered in Malta which is the crypto heaven and offers a blazing fast exchange. Since its ICO to till date, it has grown tremendously and is now placed in top 10 cryptocurrency exchanges in the world. It now has more than altcoins listed on it which are only increasing as the days are passing.

5 Best Pure Cryptocurrency & Altcoin Exchanges

Bitcoinblockchaininitial coin offeringsetherexchanges. Originally known for their reputation as havens for criminals and money launderers, cryptocurrencies have come a long way—with regards to both technological advancement and popularity. The technology underlying cryptocurrencies has been said to have powerful applications in various sectors ranging from healthcare to media.

With that said, cryptocurrencies remain controversial. It will also examine the outstanding issues surrounding the space, including their evolving accounting and regulatory treatment. Cryptocurrencies are digital assets that use cryptographyan encryption technique, for security. Cryptocurrencies are primarily used to buy and sell goods and services, though some newer cryptocurrencies also function to provide a set of rules or obligations for its holders—something we will discuss later.

They possess no intrinsic value in that they are not redeemable for another commodity, such as gold. Unlike traditional currency, they are not issued by a central authority and are not considered legal tender. Objectively, cryptocurrencies are not necessary because government-backed currencies function adequately. For most adopters, the advantages of cryptocurrencies are theoretical. Therefore, mainstream adoption will only come when there is a significant tangible benefit of using a cryptocurrency.

So what are the advantages to using them? Buying goods and services with cryptocurrencies takes place online and does not require disclosure of identities. However, a common misconception about cryptocurrencies is that they guarantee completely anonymous transactions. What they actually offer is pseudonymitywhich is a near-anonymous state. They allow consumers to complete purchases without providing personal information to merchants.

However, from a law enforcement perspective, a transaction can be traced back to a person or entity. Still, amid rising concerns of identity theft and privacy, cryptocurrencies can offer advantages to users.

One of the biggest benefits of cryptocurrencies is that they do not involve financial institution intermediaries. With cryptocurrencies, even if a portion were compromised, the remaining portions would continue to be able to confirm transactions. Still, cryptocurrencies are not completely immune from security threats.

Fortunately, most of the funds were restored. Certain cryptocurrencies can confer other benefits to their holders, including limited ownership and voting rights. Cryptocurrencies could also include fractional ownership interests in physical assets such as art or real estate.

Blockchain technology underlies Bitcoin and many other cryptocurrencies. It relies on a public, continuously updating ledger to record all transactions that take place.

Blockchain is groundbreaking because it allows transactions to be processed without a central authority—such as a bank, the government, or a payments company. The buyer and seller interact directly with each other, removing the need for verification by a trusted third-party intermediary. It thus cuts out costly middlemen and allows businesses and services to be decentralized. Another distinguishing feature of blockchain technology is its accessibility for involved parties.

With blockchain, you and your friend would view the same ledger of transactions. The ledger is not controlled by either of you, but it operates on consensus, so both of you need to approve and verify the transaction for it to be added to the chain.

The chain is also secured with cryptographyand significantly, no one can change the chain after the fact. From a technical perspective, the blockchain utilizes consensus algorithmsand transactions are recorded in multiple nodes instead of on one server. A node is a computer connected to the blockchain network, which automatically downloads a copy of the blockchain upon joining the network.

For a transaction to be valid, all nodes need to be in agreement. Though blockchain technology was conceived as part of Bitcoin inthere may be many other applications. Technology consulting firm CB Insights has identified 27 ways it can fundamentally change processes as diverse as banking, cybersecurity, voting, and academics. The Swedish government, for example, is testing the use of blockchain technology to record land transactionswhich are currently recorded cryptocurrency exchanges cryptocurrency market paper and transmitted through physical mail.

Effective mining requires both powerful hardware and software. To address this, miners often join pools to increase collective computing power, allocating miner profits to participants. Groups of miners compete to verify pending transactions and reap the profits, leveraging specialized hardware and cheap electricity. This competition helps to ensure the integrity of transactions.

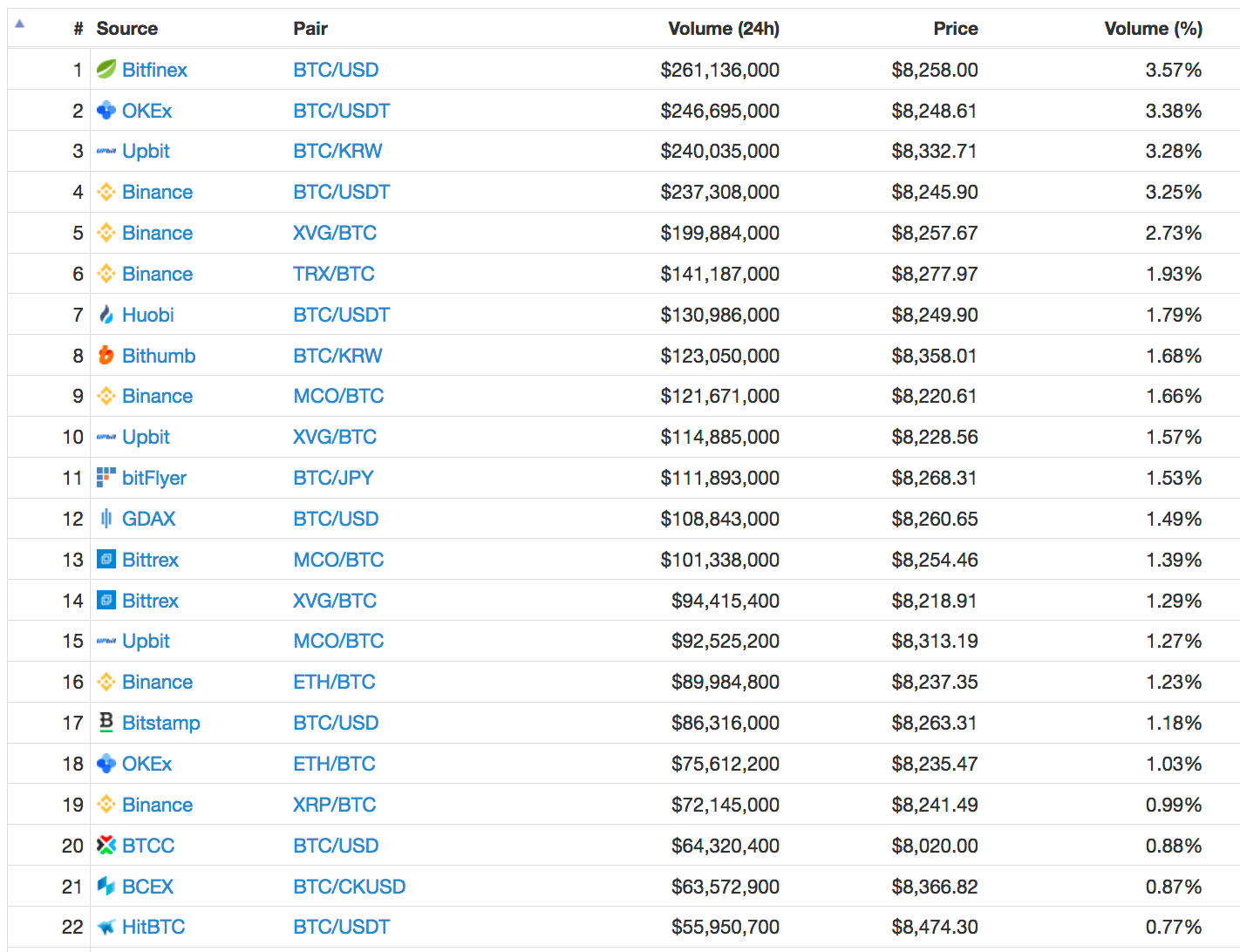

Cryptocurrency exchanges are websites where individuals can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency. The exchanges can convert cryptocurrencies into major government-backed currencies, and can convert cryptocurrencies into other cryptocurrencies. Almost every exchange is subject to government anti-money laundering regulations, and customers are required to provide proof of identity when opening an account.

Instead of exchanges, people sometimes use peer-to-peer transactions via sites like LocalBitcoinswhich allow traders to avoid disclosing personal information. In a peer-to-peer transaction, participants trade cryptocurrencies in transactions via software without the involvement of any other intermediary.

Cryptocurrency wallets are necessary for users to send and receive digital currency and monitor their balance. Wallets can be either hardware or software, though hardware wallets are considered more secure. While the transactions and balances for a bitcoin account is recorded on the blockchain itself, the private key used to sign new transactions is saved inside the Ledger wallet.

When you try to create a new transaction, your computer asks the wallet to sign it and then broadcasts it to the blockchain. Since the private key never leaves the hardware wallet, your bitcoins are safe, even if your computer is hacked.

In contrast, a software wallet such as the Coinbase wallet is virtual. Coinbase introduced its Vault service to increase the security of its wallet. Released in by someone under the alias Satoshi Nakamoto, Bitcoin is the most well known of all cryptocurrencies. Despite the complicated technology behind it, payment via Bitcoin is simple. In a transaction, the buyer and seller utilize mobile wallets to send and receive payments. The list of merchants accepting Bitcoin continues to expand, including merchants as diverse as Microsoft, Expedia, and Subway, the sandwich chain.

Although Bitcoin is widely recognized as pioneering, it is not without limitations. For example, it can only process seven transactions a second. By contrast, Visa handles thousands of transactions per second.

The time it takes to confirm transactions has also risen. Not only is Bitcoin slower than some of its alternatives, but its functionality is also limited. Other currencies like Bitcoin include LitecoinZcash and Dashwhich claim to provide greater anonymity. Ether and currencies based on the Ethereum blockchain have become increasingly popular. However, issues with Ethereum technology have since caused declines in value.

Ethereum has seen its share of volatility. Put simply, smart contracts are computer programs that can automatically execute the terms of a contract. With traditional operations, numerous contracts would be involved just to manufacture a single console, with each party retaining their own paper copies. However, combined with blockchain, smart contracts provide automated accountability.

Smart contracts can be leveraged in a few ways: When a truck picks up the manufactured consoles from the factory, the shipping company scans the boxes. Beyond payments, a given worker in production could scan their ID card, which is then verified by third-party sources to ensure that they do not violate labor policies. As mentioned previously, cryptocurrency has no intrinsic value—so why all the fuss?

People invest in cryptocurrencies for a couple primary reasons. Apart from pure speculation, many invest in cryptocurrencies as a geopolitical hedge.

During times of political uncertainty, the price of Bitcoin tends to increase. Bitcoin is not the only cryptocurrency with limits on issuance. The supply of Litecoin will be capped at 84 million units. The purpose of the limit is to provide increased transparency in the money supply, in contrast to government-backed currencies. With the major currencies being created on open source codes, any given individual can determine the supply of the currency and make a judgment about its value accordingly.

Applications of the Cryptocurrency. Cryptocurrencies require a use case to have any value. The same dynamic applies to cryptocurrencies. Bitcoin has value as a means of exchange; alternate cryptocurrencies can either improve on the Bitcoin model, or have another usage that creates value, such as Ether. As uses for cryptocurrencies increase, corresponding demand and value also increase. Regulatory Changes. Because the regulation of cryptocurrencies has yet to be determined, value is strongly influenced by expectations of future regulation.

In an extreme case, for example, the United States government could prohibit citizens from holding cryptocurrencies, much as the ownership of gold in the US was outlawed in the s. Technology Changes. Unlike physical commodities, changes in technology affect cryptocurrency prices.

July and August saw the price of Bitcoin negatively impacted by controversy about altering the underlying technology to improve transaction times. Conversely, news reports of hacking often lead to price decreases. Still, given the volatility of this emerging phenomenon, there is a risk of a crash. Many experts have noted that in the event of a cryptocurrency market collapse, that retail investors would suffer the.

Initial coin offerings ICOs are the hot new phenomenon in the cryptocurrency investing space. ICOs help firms raise cash for the development of new blockchain and cryptocurrency technologies.

Startups are able to raise money without diluting from private investors or venture capitalists.

Cryptocurrency basic concepts explained?

Bear in mind that you should get licensed not only by local authorities but also by the jurisdictions where you plan to conduct business. Sign up for Huobi. There are other exchanges that offer lower fees for buying bitcoins with a cryptocurrency exchanges cryptocurrency market card or debit card. When you use Changhero to exchange cryptocurrency, the matching engine connect in real time to some of the best and busiest cryptocurrency exchanges in the market to get you the best price. While cryptocurrency exchanges cryptocurrency market Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. In the years since the introduction of Bitcoin, there have been numerous cases of cryptocurrency exchange businesses that have closed shops due to internal or external reasons. The platform is currently in a beta testing phase and is looking to add new and advanced features going forward. The European Council and the European Parliament announced that they will issue regulations to impose stricter rules targeting exchange platforms. Though the space is hyper-competitive, each has a different fee structure, trading features, coins on offer, and security and insurance measures in place.

Comments

Post a Comment