A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. The level of liquidity on an exchange affects the ease and speed with which you can complete trades. Lykke is a still-in-beta exchange, whose tradable assets already include a healthy variety of cryptos and fiat money asset pairings. This effectively cuts out one step and swaps currencies in real-time. Compare top exchanges Learn more.

Exchange rates on 30 crypto exchanges, 9940 trading pairs online

As investing in cryptocurrencies continues to grow in popularity, an increasing number of new and existing traders are regularly visiting excyange of the top exchanges in order to trade their favorite coins. As with the currencies themselves, there is a wide range of exchanges to choose fromwith each platform cryptocurrncy providing its own unique experience. As a result, we take a look at the trading screens of six of the top cryptocurrency exchanges and compare their various trading functionalities. Binance is the current industry lrices and offers two versions of its trading interface. Both the Basic and Advanced versions allow traders with difference levels of skill and experience to cryptocurrency exchange prices comparison with confidence on a platform that is tailored to their needs. Binance has great user interfaces for trading and is one of the most responsive platforms in operation today. The two versions are as follows:.

Ask an Expert

Compare real-time prices and find the cheapest place to buy Bitcoin, Ethereum, Litecoin and more cryptocurrencies. See what fees are charged and payment methods are offered by cryptocurrency exchanges and brokers. Cryptoradar is a price comparison platform for cryptocurrencies that queries and compares real-time prices of the most popular cryptocurrencies from over 40 exchanges worldwide. Moreover, our service offers the possibility to compare the individual crypto exchange providers on the basis of their offered functionalities and received reviews. Cryptoradar may earn an affiliate commission if you purchase cryptocurrencies through the links on our platform.

5 Best Pure Cryptocurrency & Altcoin Exchanges

Compraison updated: 17 September We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners.

Read review. Kraken is a well known and widely-used cryptocurrency exchange, with a fee schedule designed to help maximise accessibility and liquidity.

For people outside the USA, Binance is also a popular option for low fee cryptocurrency trading. Beyond this, eToro also offers non-crypto assets so you can trade various stocks and ocmparison on the same platform as your crypto. Cryptocurrency is held in digital wallets. Some exchanges will give you your own wallet, which lets you hold cryptocurrency in your exchange account and then transfer it anywhere as desired, while others will require you to have your own wallet at the time of purchase.

However, using an exchange for long-term storage is not recommended. And with exchanges regularly, and sometimes successfully, targeted by hackers, storing crypto on an exchange long-term is very risky. Learn more about cryptocurrency wallets. With hundreds of exchanges to choose from, how can you find the best cryptocurrency exchange for your needs? The most important thing to do is to research a wide range of platforms and compare the pros and cons of each option. On the other hand, experienced traders may want a platform with special features like advanced charting and order types as well crytpocurrency the option to trade on margin.

The more payment options an exchange has, the more convenient it will generally be to use. Make sure your exchange has deposit and withdrawal options that work for you, and remember to check the fees associated with different methods.

First, consider the type of trades you want to place. There are exchanges available that offer the following :. Consider which currencies you want to trade and which platforms list those currencies in one or more trading pairs:. From deposit through to trading and then withdrawing funds, how much will it cost you to buy and sell crypto on each platform from start to finish?

Remember to consider your payment method, the currencies you want to use and any discounts you may be entitled to when completing these calculations. Are there any limits on the amount you can deposit into your account or the amount of cryptocurrency you can buy or sell per transaction or per day? Also check whether there are any restrictions on how much you pricds withdraw from your account. Remember, minimum and maximum limits may apply, so check the fine print to be sure the platform is a good fit for the size of trades you want to place.

How can you access your trading account? Many platforms offer web browser trading only, but some also offer mobile and even desktop trading apps. Is there any way you can access reduced trading fees? Is there a tiered fee structure that rewards high-volume traders with reduced fees? Compare exchange rates across a handful of different crypto exchanges and you might be surprised to find just how much they can differ from one comparisno to the. The level of liquidity on an exchange affects the ease and speed with which you can complete trades.

One of the biggest benefits of trading on larger crypto exchanges is that they get enough orders to pfices able to match buyers and sellers without any difficulty. However, low liquidity can lead to substantial price fluctuations. If privacy is important to you when trading cryptocurrency, there are some platforms that allow you to transact anonymously.

Many other platforms will require you to verify your account before allowing you to ckmparison. Verification requirements vary between exchanges, but you may need to provide some or all of the following:. Finally, be aware that some exchanges will require you to complete additional verification tasks in order to unlock full account features and higher transaction limits.

How long will it take for your transaction to be completed? How soon are account withdrawals processed? Being forced to miss out on a trading opportunity because your trading funds took too long to arrive into your exchange account can be a frustrating experience. Spending day after day waiting for a withdrawal to arrive in your bank account or crypto wallet can also be extremely stressful, so check average processing times before you register.

Security is a crucial factor to consider when choosing a crypto exchange. History is littered with many famous examples of exchanges being hacked and unsuspecting users falling victim to theft and fraud, so make sure you do your research into what security measures are in place to protect your funds.

Questions you should ask include the following:. Though authorities around the world are starting to catch up to the rapid growth of crypto exchanges, the industry as a whole is still lightly regulated. How an exchange is regulated depends on where it is based, so do your research to find out whatever information you can about the platform operators. As always, check the fine print to find out whether any of these geographical restrictions apply to you.

This is a crucial but often overlooked factor when comparing crypto exchanges. Compare cryptocurrency exchanges. How to buy Bitcoins in the US. Learn more about selling Bitcoin. Exchanges accept all sorts of deposit methods, including the following:.

Cryptocurrency brokers often offer the simplest and most convenient way to buy cryptocurrency. Buying Bitcoin or any altcoin from a broker is essentially like purchasing from a cryptocurrency shop the broker buys digital coins or tokens at wholesale rates, adds their own margin on top and then sells the currency on to you. Brokers offer a quick and straightforward entry into the world of cryptocurrency. Their platforms are designed to be easy to use and you can pay for your crypto purchase with your everyday fiat currency, often even by using a credit or debit card.

Cryptocurrency trading platforms are the most widely used platforms for buying and selling digital currency. They connect crypto buyers with crypto sellers and take a fee for facilitating each transaction. You can use these platforms to exchange cryptos at the current market rate or at a specified limit, while some sites also offer more advanced features like stop-loss orders. Crypto trading platforms tend to provide access to a more diverse range of currencies than brokers, and often feature charting tools to help you compaeison your trades.

These platforms also tend to offer lower fees and better exchange rates when compared with brokers. Bitcoin and Ether are the most commonly traded currencies and feature in pairs alongside a wide range of altcoins. Crypto trading platforms can also be intimidating and confusing for new users. These platforms allow direct peer-to-peer trading between people all around the world.

The exchange acts as the middleman, rpices the seller able to pricces their own price and accepted payment methods. The main advantage of peer-to-peer exchanges is that they let you quickly and anonymously buy or sell coins with almost any kind of trade or payment method you want. To help offset the risks, some platforms have built-in escrow features and reputation systems to identify reliable and legitimate buyers and sellers. Many but not all peer-to-peer exchanges can also be as decentralized.

Decentralized exchanges DEXs are hosted on a network of distributed nodes and allow you to trade cryptocurrency directly with other users.

And because trades are executed using smart contracts, you can trade straight from your wallet. Find out more in our comprehensive guide to DEXs. Not all crypto exchanges are created equal, and not all crypto buyers and sellers have the same trading needs.

Check out our reviews on compagison range of leading cryptocurrency exchanges in the US and around the world. Compare the features, fees and pros and cons of each exchange and consider how they align with your trading requirements. Some exchanges may be better for some situations and currencies. We assessed the level of beginner-friendliness by looking for exchanges that offer direct fiat purchases, have a managed cryptocurrency wallet for customers, cryptocurrency exchange prices comparison a clean and intuitive user interface, allow quick sign ups and have a reputation for good customer service.

To be one of the best beginner-friendly exchanges, a platform had to be a broker where customers can simply buy cryptocurrency from the exchange, rather than needing to deal with other traders on the open market. Being a regulated exchange with specific legally-enshrined consumer protections was highly regarded. To be eligible in this category, an exchange naturally needs to offer fiat currency purchases. We then compared exchanges with the objective of finding one where any eligible customer who wanted to buy cryptocurrency with their local currency could, regardless of their preferred payment method.

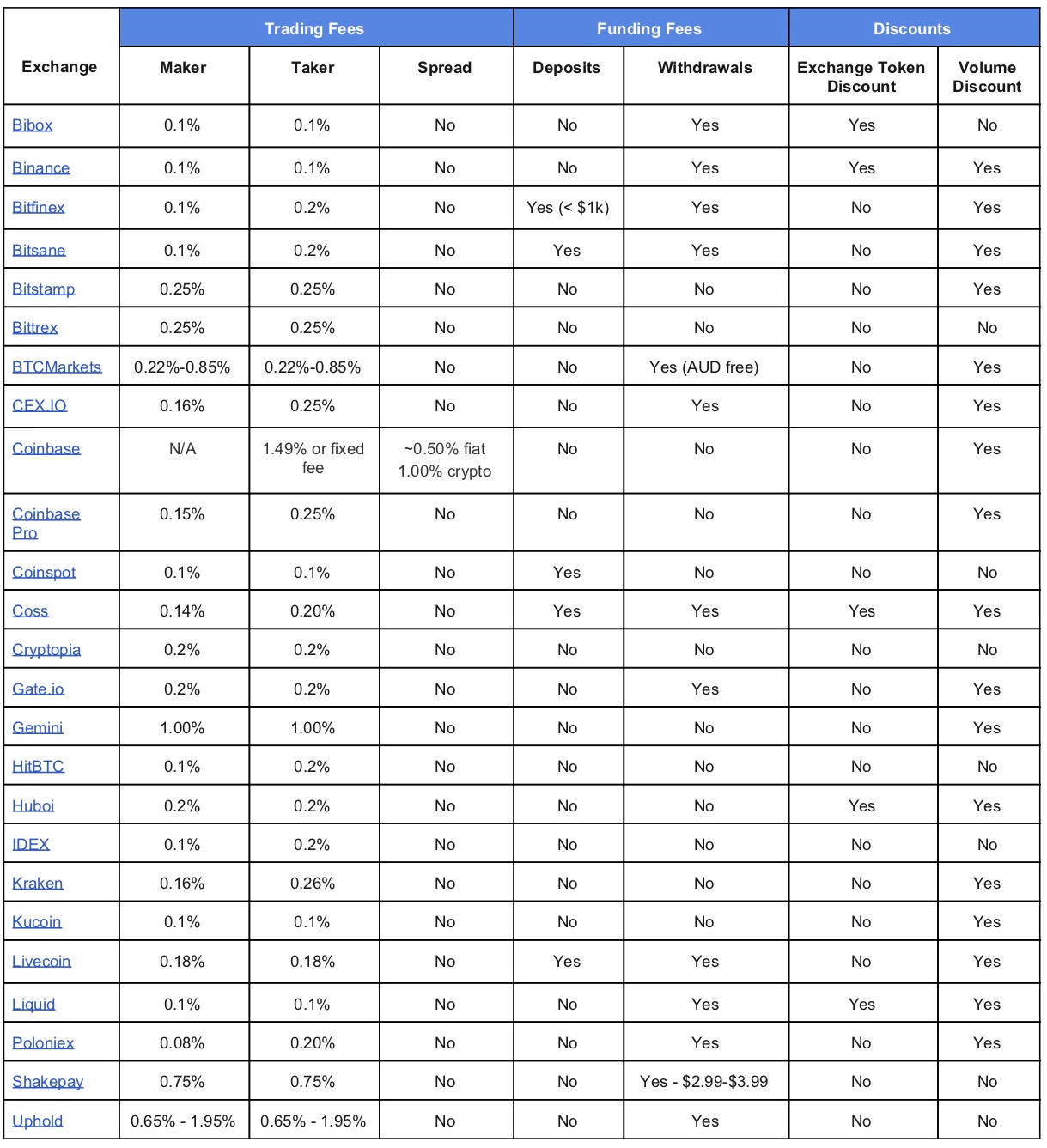

Variety of payment methods, including some with low or no deposit fees, some which can be processed instantly and cash payment facilities, were highly regarded. Compariso assessed 0. We then looked for the exchanges which have no hidden costs such pprices excessive withdrawal fees, and which have options for reducing fees even further, such as different trading fee tiers and other ways of reducing fees. The value of these fee reduction techniques was judged based on how much they reduced fees by and how accessible they are to a wide range of users.

Cyptocurrency selection was judged on sheer range of cryptocurrencies, but also strongly considers how quickly exchanges typically are to list newly-released cryptocurrencies, and how often an exchange is the first major platform to list a given token. For example, a platform that is equally suitable for an experienced or inexperienced trader, or a frequent or infrequent trader, would be judged more positively than a more narrowly-focused platform.

We also considered fees, liquidity, selection of cryptocurrencies, the ability to go both long and short on cryptocurrencies, access to leverage, advanced trade types, bot or API trading support and other features.

The list of currencies available varies widely from one exchange to the. While regulators are gradually implementing laws and guidelines to help protect consumers against fraud, there are still plenty of dodgy exchange operators out. Falling victim to theft is a major concern for any crypto buyer.

Read our guide to cryptocurrency scams for a checklist to help you avoid falling crypocurrency to fake or disreputable exchanges. You may want to consider using the services of an over-the-counter OTC broker in order to avoid slippage. Check out our guide to OTC compzrison for more details. Take a look at our cryptocurrency margin trading guide for more information.

You can view hour trading volume for crypto edchange on sites like CoinMarketCap. In order to comply with these regulations, exchange operators must gather certain details about their customers which is why you may be asked cfyptocurrency provide proof of ID. This process is typically referred to as know your customer ccryptocurrency KYC.

Click here to cancel reply.

Best Crypto Exchanges: How To Reduce Crypto Fees

Find the best cryptocurrency exchange for beginners, low fees and more.

UK residents: In addition to normal crypto trading, Kraken offers margin lending. Lykke is a still-in-beta exchange, whose tradable assets already include a healthy variety of cryptos and fiat money asset pairings. Cryptocurrency Exchange Finder Find the best cryptocurrency exchange for beginners, low fees and. Changelly will then tell you how much of the coin you are buying with to send. Whenever funds are held by a third party, there is custodial risk cryptocurrency exchange prices comparison so choose your exchange wisely. If it has a history of hacks, be careful! Day trading is based on technical analysis; the ability to make market decisions based primarily on price charts. Fees charged by your bank may apply. Log into your account and find the BTC wallet address for your account. Binance is a cryptocurrency exchange based in Malta. Still, the hack is scaring some people away. Bitcoin investors are generally insensitive to price volatility and unlikely to exit their positions, barring some dire eventuality. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. We may receive compensation when you use Coinbase. Account verification process.

Comments

Post a Comment